It’s a worthwhile process, given the evolution that is revealed.

Past

The first year of full cannabis legalization in Canada (commencing October 17, 2018) has been widely characterized as a failure. The source of that disappointment is simple: not enough licensed cannabis stores, resulting in below-expectation sales.

The biggest culprit here was the province of Ontario. Canada’s largest province (population 14+ million) didn’t open its first cannabis store until April 1, 2019, nearly six months after legalization. At the end of Year 1, it still had only licensed 25 cannabis stores.

Canada’s other largest provinces by population, Quebec and British Columbia, were not much better. Quebec has even less licensed stores than Ontario, although its population is much smaller (8 million).

British Columbia (population 5 million) generated only CAD$25 million in sales through the first 10 months of legalization, according to Statistics Canada. This compares with CAD$144.9 million in neighboring Alberta (population 4 million).

Despite the failures from Canada’s largest provincial governments, overall cannabis sales tripled in Canada during the first year of legalized recreational cannabis. Monthly cannabis sales have been consistently growing at a double-digit pace in recent months.

Alberta led the way in Canada in Year 1. It opened up 306 cannabis stores and generating among the highest per capita sales.

Still, the clearest indication of failure over the past year in the Canadian cannabis industry can be summed up in one statistic.

At the end of Year 1, the cannabis black market still controls roughly 85% of sales. This compares with a February 2019 estimate from Vice that the black market could account for 72% of recreational cannabis sales in 2019.

It was a slow start to the first year of cannabis legalization in Canada. However, the industry gained momentum as the year progressed.

Frame the temperature of Canadian cannabis retail in Year 1 as “cold”.

Present

As Canada moves into the second year of cannabis legalization, there are two immediate reasons to be much more encouraged about near-term prospects for Canadian cannabis retail.

- Canada has reached a critical mass in its total number of licensed cannabis stores

- Phase 2 of legalization brings a wide array of derivative cannabis products (concentrates, edibles, and infused beverages) and will greatly increase the number of consumers

Together, these two factors guarantee much stronger revenue numbers in Year 2.

Canada now has over 700 licensed cannabis stores. Ontario has announced plans to triple licensed cannabis stores, although the province has had further stumbles here. Quebec is planning to double its cannabis stores. B.C. is in the process of doubling its cannabis stores.

Alberta plans to have 500 cannabis stores by the end of 2020. Other Canadian provinces are also accelerating the pace of store-openings. This alone would translate into a robust gain in sales.

Phase 2 of legalization offers additional drivers for demand and revenue growth. Introducing cannabis derivative products (currently available only on the black market) is expected to lure an additional 3 million consumers to the legal market – equating to roughly a 50% increase in the consumer base.

In U.S. states with fully legalized markets, it is these derivative cannabis products that have been leading the way in sales growth. According to Arcview and BDS Analytics, concentrates (41% CAGR) and edibles (33% CAGR) are both expected to outpace dried flower (20% CAGR) in sales growth between now and 2022.

These will also generally be higher margin cannabis products. And Phase 2 is expected to bring in proportionately more female consumers. New products are expected to reach store shelves in December.

Lots more stores. Lots more consumers. Lots more products. Generally higher margins.

Frame the temperature for Canadian cannabis retail today as “warm”.

Future

The main reason why cannabis investors should be enthusiastic about Canadian cannabis retail is future potential. The Canadian cannabis industry has the capacity to accelerate in demand and revenues over a very extended period.

To fully understand this requires doing three things.

- Comparing Canada’s cannabis industry to Colorado’s cannabis industry.

- Comparing Canada’s cannabis industry to its alcohol industry.

- Looking more closely at Alberta’s cannabis success.

Colorado was the first U.S. state to legalize recreational cannabis. It is now in the sixth year of full legalization. Previous predictions for the state’s cannabis industry projected that demand would start to rapidly level off after 4 years.

In fact, Colorado’s legal industry continues to exhibit robust growth, with new sales records in four of the last five months. August’s sales record beat the July record by 4%.

Even more remarkably, Colorado’s legal cannabis industry has been able to generate this level of success despite nearly two-thirds of Colorado’s cities and counties continuing to ban legal cannabis stores (source: Leafly). There is still considerable future growth potential in Colorado’s cannabis industry.

Note that Canada’s cannabis industry benefits from a higher base consumption rate versus the U.S. Despite several U.S. states having legalized cannabis ahead of Canada, the cannabis consumption rate among Canadians already exceeds that of any U.S. state. More on this later.

Then there is the comparison with the alcohol industry. Even with over 700 cannabis retail outlets today, the Canadian alcohol industry boasts roughly ten times that number of retail outlets, according to data from Echelon Wealth Partners.

As Canada’s cannabis industry matures, there is no reason the legal cannabis industry can’t have a retail footprint at least as large as that.

- Cannabis is much safer than alcohol, while offering consumers a number of pleasant effects and health benefits

- Cannabis also has a second large additional market as medicine.

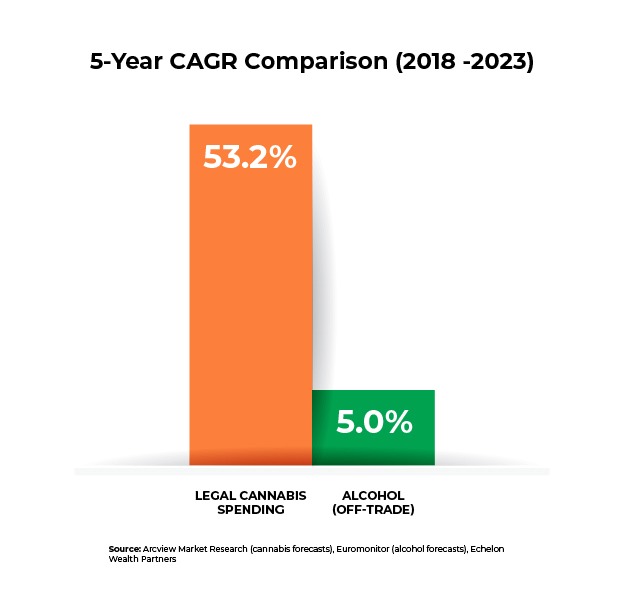

Alcohol sales are now declining in terms of units. Current revenues and projected growth are below the rate of inflation. In contrast, legal cannabis spending is expected to expand in Canada between now and 2023 at a 53.2% CAGR.

Echelon Wealth Partners is very bullish on the potential of the legal cannabis industry to claim market share from the cannabis black market.

We would expect that by 2024 (approximately 5 years post-legalization), that as much as roughly 80% of total demand could reasonably be migrated into legal sales channels.

That projection may be overly ambitious, given the experiences in several U.S. states as well as Year 1 of Canada’s legalization. However, there is still another important driver to factor into Canadian cannabis demand.

As Alberta rapidly opened up its legal cannabis industry, this had an enormous impact on consumers. Over the first year of legalization, Alberta’s cannabis consumption rate rose from 16% to 20% (source: Statistics Canada). That’s a 25% increase in cannabis consumers over just 12 months.

As Canadians get more access (and exposure) to legal cannabis, we’re seeing demand increase commensurately. And again, this is a growth dynamic that can continue for many years.

Roughly 80% of Canadian adults consumed alcohol products over the past year. This is despite the fact that more and more consumers are reducing their drinking because of the numerous health perils associated with alcohol consumption.

Cannabis presents none of those risks. Over time, there is no reason why consumption rates for cannabis could not approach (or exceed) consumption rates for alcohol.

This means that in addition to claiming market share from the cannabis black market, the legal cannabis industry can expect to generate enormous numbers of new cannabis consumers.

The consumption rate for cannabis would have to increase by a factor of five from current levels to equal the consumption rate for alcohol.

The number of retail cannabis outlets would have to increase by a factor of ten to equal the retail footprint of the alcohol industry.

When we multiply strong, sustainable growth in the number of cannabis stores with strong, sustainable growth in the number of cannabis consumers, the product is not linear growth. It translates into accelerating growth – for many years to come.

Frame the temperature for Canada’s cannabis retail sector in the future as “hot”. After a slow start, there is a Canadian cannabis retail explosion underway.