On the surface, it’s a review of the “paradigm shift” from supposedly low inflation to high and higher inflation.

Beneath the surface, however, we see an exercise in revisionism. The writer attempts to depict the clear capitulation on inflation by most Western central banks as (instead) some sort of calculated policy choice.

Cause and effect: central banks didn’t “choose” inflation, they created it

Folkerts-Landau’s report is a cynical exercise: pretending that central banks are choosing to accept something that they are helpless to prevent. Understanding this requires a more sophisticated understanding of inflation.

This was provided to readers in a recent Dynamic Wealth Research article.

You dilute a stock and it loses value. You dilute a currency and it loses value.

It’s not a difficult concept to grasp, unless you happen to be a central banker or an economist. To these “experts”, the concept of dilution is unfathomable.

It’s not a difficult concept to grasp, unless you happen to be a central banker or an economist. To these “experts”, the concept of dilution is unfathomable.

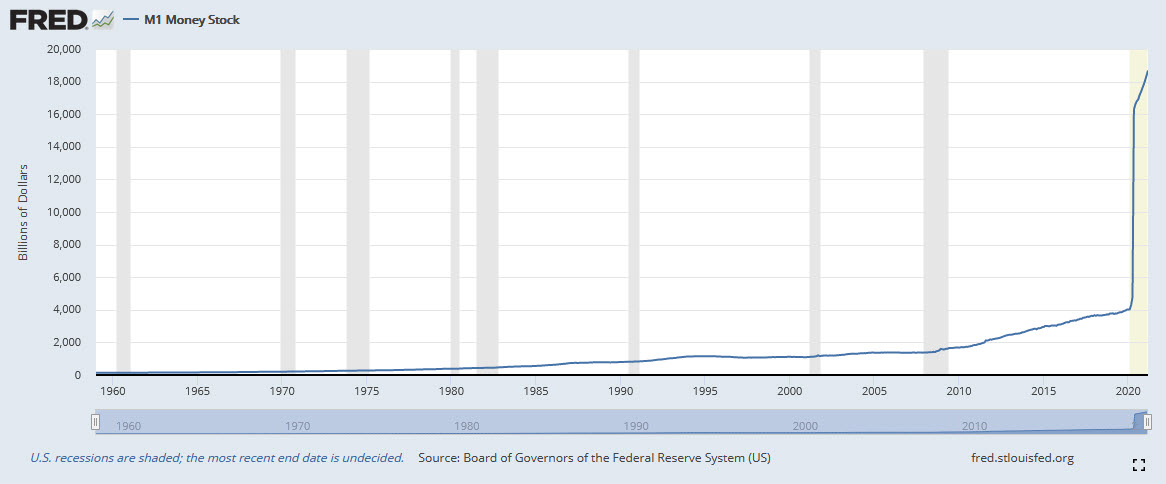

The dilution of the U.S. dollar is as undeniable as it is extreme.

Indeed, the (correct) economic definition of inflation is to increase (“inflate”) the supply of money.

Dilute the currency by increasing the supply. The currency loses value. Prices rise. Cause and effect.

Once upon a time, real economists understood this.

Inflation is always and everywhere a monetary phenomenon in the sense that it can be produced only by a more rapid increase in the quantity of money than output. [emphasis mine]

- Milton Friedman, 1970

But today, in the fantasy-world of Western central bankers and modern pseudo-economists, such cause-and-effect doesn’t exist. Central banks aren’t causing the recent explosion in inflation, they are merely accepting it.

The reality is that have absolutely no choice.

After you initiate a cause, you can’t wish away the effect. The U.S. dollar (along with other Western currencies) has been diluted – past tense. Now we are reaping the consequences: soaring inflation.

Back to the revisionism. According to Folkerts-Landau:

The most immediate manifestation of the shift in macro policy is that the fear of inflation, and of rising levels of government debt, that shaped a generation of policymakers is receding.

The level of deceit here is deplorable.

This is like depicting Global Warming as humanity (for some reason) ‘losing its fear’ of the catastrophic consequences of a sudden/dramatic increase in global temperatures.

Climate change wasn’t a policy choice. It was a crime against the environment, which was maliciously and aggressively denied and covered up (for decades) by its chief perpetrators – until it was no longer possible to cover up.

So, too, it is with central bank-created inflation. This wasn’t some economic accident to which central banks (and our pathetic governments) are now acquiescing. This was a deliberate monetary crime by the Federal Reserve and other Western central banks.

And it didn’t start with Jerome Powell.

Former Fed Chairman B.S. Bernanke unleashed his own tidal wave of money-printing (inflation) from 2009 – 2013. This tidal wave can’t be seen in the original chart (above) because Powell’s hyperinflationary explosion of dollar-creation has dwarfed it.

Bernanke’s monetary tidal wave did not lead to an explosion in price inflation. What happened to “cause and effect”?

There are two differences between the Bernanke Helicopter-Drop and the Powell Pump.

- The Powell Pump is (as noted) simply much more extreme.

- The vast majority of funny-money created by Bernanke ended up being sequestered from the broader economy – primarily via being funneled into the Big Bank’s $1.5 quadrillion derivatives casino.

Today, not only has Jerome Powell conjured many more trillions of dollars into existence (much faster than B.S. Bernanke) but the Fed has had no choice but to release much of this funny-money into the broader economy – to prop-up the shattered U.S. economy.

Folkerts-Landau continues his charade.

Sovereign debt has risen to levels unimaginable a decade ago with large industrial countries exceeding red-line levels of 100% of GDP. Yet, there is little serious concern about debt sustainability on the horizon from investors, governments or international institutions. Similarly on inflation, the vast majority of central bankers and economists believe any rise in prices away from the historically-low levels of the last decade will be transitory. It is assumed that base line effects, one-offs, and structural forces will continue to suppress prices. [emphasis mine]

Nonsense.

Sovereign debt isn’t rising because Western governments have “little concern” for it. Rather, a collection of economies that were already hopelessly insolvent have thrown in the towel on fiscal management the same way that their central banks have thrown in the towel on inflation.

Before Western governments crippled their own economies with COVID-19 lockdowns of dubious wisdom, these governments were already “monetizing debt”.

Their central banks were conjuring new funny-money into existence for the sole purpose of making interest payments on our governments’ unrepayable debts and soaking up the supply of new bonds.

That’s how the debts of these hopelessly insolvent debtors are being “sold” (lol) at the highest prices in history. Monetizing debt is (infamously) the last resort of insolvent economies.

And then the COVID-19 crisis struck.

Did Western governments have a “choice” about whether to take on vastly greater debts? Yes, they could (can) acknowledge their insolvency – and declare bankruptcy.

Absent that admission, these Deadbeat Debtors have absolutely no choice but to accelerate building their mountains of debt to the sky.

It is equally absurd and deceitful to suggest that current, soaring (price) inflation will be “transitory”. As already noted, much of the Powell Pump has been to buy the (bad) debts of the U.S. government: U.S. Treasuries.

Unless the U.S. government declares bankruptcy, it will continue issuing new Treasuries like confetti. And Powell will (must) continue his hyperinflationary currency-creation to monetize these soaring debts. U.S. inflation is only “transitory” in the sense that it will be possible to reign in after a formal declaration of bankruptcy by the U.S. government.

However, Folkerts-Landau does manage to wedge in a kernel of honesty amid his serial revisionism.

Where the US leads, others tend to follow.

Yes, other (equally insolvent) Western economies and central banks will also continue to deny reality and continue along the path to full-scale hyperinflation and complete economic implosion.

They will do so because their only choice is to openly acknowledge their folly – and openly accept the consequences.

Gold is salvation

Hyperinflation represents the destruction of all wealth denominated in the hyperinflated currency.

Salvation is obvious. Make sure that your wealth is not “denominated” in U.S. dollars or other (near-worthless) Western currencies.

That clearly means getting out of cash. It also means vacating all dollar-denominated instruments – starting with U.S. Treasuries.

Gold is the obvious destination.

Two thousand years ago, in ancient Rome, a gentleman of that era could purchase the finest suit of clothing with a 1-oz gold coin: a custom-made toga, along with a leather belt and sandals.

Four hundred years ago, a gentleman of that era could also purchase the finest suit of clothing with a 1-oz gold coin: a tailored suit and accessories.

Today, with a 1-oz gold coin, a gentleman can still purchase a fine suit and accessories with a 1-oz gold coin. But because the price of gold has been heavily suppressed in recent years, you would (temporarily) have to buy off the rack.

That’s two thousand years of protection against inflation.

In contrast, the U.S. dollar has lost 99% of its value in 100 years. And many pseudo-analysts and charlatan economists have labeled the depreciating dollar a Safe Haven.

Four hundred years ago, a gentleman of that era could also purchase the finest suit of clothing with a 1-oz gold coin: a tailored suit and accessories.

Today, with a 1-oz gold coin, a gentleman can still purchase a fine suit and accessories with a 1-oz gold coin. But because the price of gold has been heavily suppressed in recent years, you would (temporarily) have to buy off the rack.

That’s two thousand years of protection against inflation.

In contrast, the U.S. dollar has lost 99% of its value in 100 years. And many pseudo-analysts and charlatan economists have labeled the depreciating dollar a Safe Haven.

The U.S. dollar was a leaky bucket for our wealth long before Bernanke and Powell commenced its final destruction.

Gold has provided complete protection from inflation for roughly ten times as long as the U.S. dollar has existed.

Central bankers and sycophantic economists continue to feign ignorance about inflation in every respect. They feign ignorance about its cause. They feign ignorance about its severity. They feign ignorance about its duration.

Listen to these monetary charlatans and the U.S. dollar will become the Zimbabwe dollar while wiped out dollar-holders are still holding the bag.

Remarkably, near-worthless U.S. dollars can still be exchanged for gold at a rate of less than $2,000 per 1 ounce. Silver is an even greater bargain for those looking to exit these dying currencies.

You can buy gold (or silver). Or, you can be a deer in the headlights.

It’s a pretty clear choice.