- Hyperinflation is the ultimate economic catastrophe: a wealth-destroying tidal wave caused by a currency plunging to near-zero

- This catastrophe is now imminent and there are several strong reasons why there is absolutely nothing “transitory” about it

This week we witnessed something unprecedented in the media. A Big Bank used the “h” word. More on this later.

For months, Dynamic Wealth Research has been warning of the imminent risk of U.S. hyperinflation. That was not a “prediction”.

Fed Folly Part 1: We Already Know How This Will End, The USD Goes To Zero

Fed Folly Part 2: How The Federal Reserve Will Finish Its Destruction of The Dollar

Fed Folly Part 2: How The Federal Reserve Will Finish Its Destruction of The Dollar

Predictions imply an element of uncertainty. And there was never anything uncertain about this.

To understand this reality, it’s first necessary to obtain a proper understanding of inflation.

Creation of the hyperinflation time-bomb

What uneducated media drones, deceitful central bankers and intellectually lazy economists call “inflation” is actually price inflation. It is the consequence of actual inflation.

The correct economic definition of “inflation” is to increase (or inflate) the supply of money. Here it has been obvious for many years that Western central banks – and the Federal Reserve in particular – have been on a hyperinflationary trajectory.

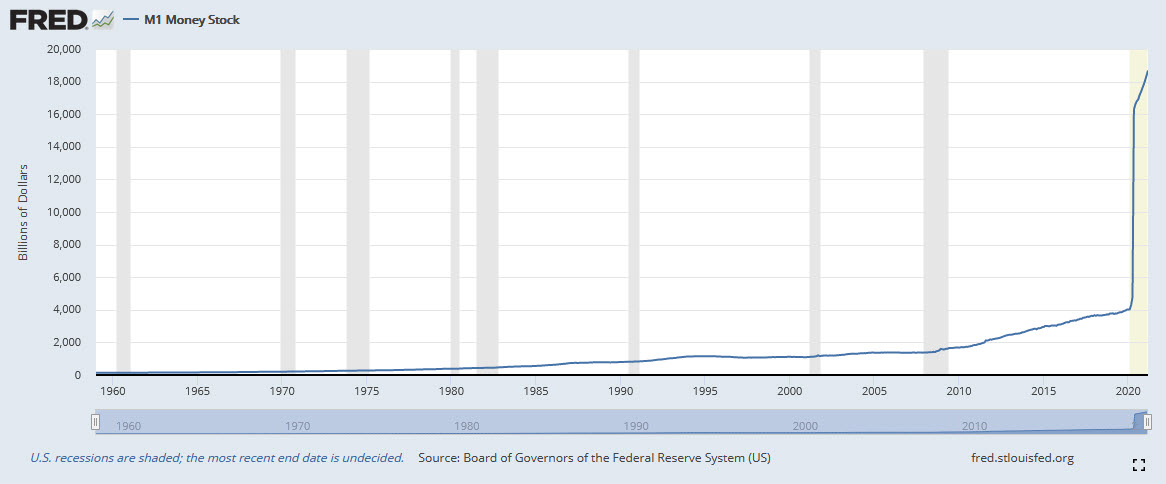

Behold the first hyperinflationary money-printing binge from the Fed, courtesy of monetary psychopath, B.S. Bernanke.

Look at the stability of the U.S. money supply, decade after decade, until the Fed-heads of the modern era (beginning with Alan Greenspan) began going berserk with their currency creation.

Now look at the second hyperinflationary money-printing binge from Jerome I-wouldn’t-recognize-inflation-if-I-saw-it Powell. It has dwarfed Bernanke’s (and Greenspan’s) own monetary extremism.

Thanks to the magnitude of Powell’s folly and years of the Fed aggressively ‘massaging’ this chart, you can’t even see the vertical spike in money-printing that Bernanke started in 2009.

Many people were “predicting” U.S. hyperinflation (including myself) at the time of Bernanke’s hyperinflationary currency creation. Today, we are reporting on Jerome Powell’s hyperinflation.

Detonation of the hyperinflation time-bomb

Now this hyperinflation has been publicly unmasked – via a new report from Bank of America.

“On an absolute basis [corporate] mentions [of inflation] skyrocketed to near record highs from 2011, pointing to at the very least, “transitory” hyper-inflation ahead.” [emphasis mine]

Here, obviously, the reference to “hyper-inflation” is meaning price inflation: hyperinflationary price increases.

Why have “mentions” of inflation in corporate boardrooms increased by 800% y-o-y? Two reasons.

- More and more people understand the significance of the two vertical lines above.

- Asset price inflation: soaring real estate prices, soaring food prices, soaring stock prices, soaring bond prices, soaring steel prices, soaring lumber prices, a nine-year high in the commodities index.

Actual inflation (increasing the money supply) causes price inflation for the simplest of reasons: dilution.

Central banks radically dilute their un-backed paper currencies with hyperinflationary money-printing. Prices for goods and services (in these radically diluted currencies) soar as a result. Cause and effect.

A company issues new stock (diluting its share structure) and the share price falls. It’s not like the concept of financial dilution is any sort of mystery.

Yet central bankers consistently deny this obvious cause-and-effect.

Expected.

These are serial arsonists trying not to draw attention to their own monetary bonfires. But denial is no longer an option.

Virtually overnight, bankers have gone from totally denying the existence of central bank-fueled inflation (for the past 10+ years) to now warning of imminent hyperinflation.

This is not a flip-flop that investors should take lightly.

(Price) hyperinflation is the ultimate economic catastrophe: worse than any “great” depression – by an order of magnitude.

It is wealth destruction, of anything and everything denominated in the hyperinflated currency.

There is nothing “transitory” about the coming hyperinflation

There have been instances of “transitory hyperinflation” in the modern era. But principally this occurred in the Eastern bloc countries of the former Soviet Union.

They experienced a sudden and severe economic shock. The crisis passed and hyperinflation receded.

The hyperinflation-in-progress in the United States (and much of the Western world) is not sudden. It has been building – as shown above – for well over a decade.

It is the product of two realities, neither of which is in any way transitory.

a) Recklessly excessive and totally unprecedented currency creation by Western central banks.

b) Fiscally bankrupt Western governments that are now forced to monetize their debts with more and more central bank funny-money.

b) Fiscally bankrupt Western governments that are now forced to monetize their debts with more and more central bank funny-money.

The only way that the hyperinflation caused by this fiscal and monetary mismanagement could be “transitory” is if (when) Western nations formally declare bankruptcy – and Debt Jubilee begins.

The end of the U.S. dollar, the collapse of U.S. Treasuries

Currencies and bonds are at the top of the list in terms of wealth destruction from hyperinflation.

These are paper instruments that can (will) descend to virtual worthlessness as this hyperinflation progresses. This means U.S. dollars and ultra-fraudulent U.S. Treasuries.

Why are U.S. Treasuries an obvious fraud?

Because they are priced at literally the highest prices in history while they are on an inevitable path to worthlessness.

If the Fed continues its hyperinflationary destruction of the dollar, the U.S. government may not formally default on these worthless debt instruments. But when the USD itself is valued at near-zero, these bonds will literally not be worth any more than the paper they are printed on.

Anyone living in the real world knows that the only reason that Western bond prices are anywhere close to their current (fraudulent) levels is that the supply of these bonds is being soaked up with fresh central bank money-printing.

If the Federal Reserve stops monetizing U.S. debt with trillions upon trillions of new funny-money? No buyers.

Interest rates on the unprecedented supply of these distressed bonds would immediately shoot up to market rates (i.e. somewhere north of 10%). Interest alone on the U.S.’s $28.2 trillion national debt would exceed government revenues. Zero dollars left over to fund government operations.

And then, absent new trillions in Fed money-printing (more hyperinflation), the U.S. government would be quickly forced into formal debt default. Bankruptcy.

No way out.

This catastrophic dead-end has been obvious for a while now – to anyone with a correct understanding of economic principles.

Inflation is always and everywhere a monetary phenomenon in the sense that it can be produced only by a more rapid increase in the quantity of money than output. [emphasis mine]

- Milton Friedman, 1970

Milton Friedman was a real economist, unlike the modern-day charlatans who attach that label to themselves.

“Always and everywhere”. Friedman was absolutely unequivocal about how central bankers create inflation.

In contrast, central bankers and today’s pseudo-economists regularly deny the existence of soaring (price) inflation – with absurdly doctored statistics. And they feign complete ignorance about understanding the real cause: excessive currency creation.

Look at the charts above. Have B.S. Bernanke and (now) Jerome Powell been increasing the supply of money in the U.S. faster than economic output has increased?

Is a Ferrari faster than a tricycle? You would have to be blind (or willfully ignorant) not to see this.

Massive currency dilution.

Cause and effect. Hyperinflate the supply of currency and (sooner or later) hyperinflation of prices will follow.

Now it’s time to pay the piper. Except it won’t be wealthy bankers who suffer from Bernanke’s and Powell’s monetary crimes. It will be the Average American.

Gold and silver: ultimate inflation insurance

Gold and silver have been humanity’s ultimate shield against inflation (and the bankers who create it) for as long as we have had banks. This ultimate protection against inflation extends right through to today.

Pseudo-economists and (of course) Federal Reserve bankers talk about the U.S. dollar as “a safe haven”. The reality is opposite to this. And now the depreciation of the Mighty Dollar is really starting to accelerate.

Silver has lagged gold as an inflation shield in recent decades. But it continues to possess the same monetary (and wealth preservation) properties. Put another way, silver should appreciate much more than gold – as the gold/silver price ratio shifts back toward rational levels.

Parallel to the Federal Reserve’s destruction of the U.S. dollar has been the destruction of global silver stockpiles, via serial under-pricing and perennial supply deficits.

The world’s silver supply is gone, literally used up and thrown away, in landfills around the world.

Gold, on the other hand, benefits primarily from demand. The Metal of the Sun is now the metal in peak demand by the world’s central banks.

As the world’s inflation-creators torch their own currencies, central banks have loaded up on gold over the past decade in an unprecedented manner.

Gold mining stocks are also a hyperinflation hedge

While stocks are also paper instruments, they are not unbacked paper instruments like bonds and currencies. Stocks are backed by the hard assets of the company in which they represent “shares”. In the case of gold mining stocks, the hard asset backing these shares is gold.

Gold mining stocks are not “as good as gold” as inflation insurance. But they’re close.

And if (somehow) we are fortunate enough to suffer through only high inflation rather than true hyperinflation, they can be expected to outperform the price of gold due to the inherent leverage in mining stocks.

In any currency crisis brought on by hyperinflation, trading in these stocks may be disrupted. This is simply because the market would not be able to (rationally) re-price these shares as fast as hyperinflation devalued the currency in which they are denominated.

But there is no risk of a collapse to worthlessness – as would (will) certainly occur with currencies and bonds.

Cryptocurrencies are not a hedge or shield of any kind against inflation.

Cryptocurrencies have no intrinsic value. They don’t even provide adequate utility as currencies, since their insane volatility makes them totally impractical for most commercial purposes.

A “currency” whose primary use is as a gambling token is not a legitimate currency. It’s certainly not a Safe Haven.

Hard assets (like gold and silver) shield us from inflation because they retain their intrinsic value as paper instruments implode.

For many years now, it has been obvious that the hyperinflation Genie would soon be released from its bottle – thanks to the willful monetary recklessness of Western central banks.

This day has now arrived and yet (in our brain-dead markets), gold and silver are still bargain-priced, along with the mining stocks. Literally a final chance for people to avoid much of the economic carnage from the monetary tidal wave known as hyperinflation.