The population of the United States is just under 330 million people. The population of Canada is 37.5 million people.

Canada has fully legalized cannabis nationally. In the U.S., cannabis is now fully legal in 11 states, with medicinal cannabis legalized in 33 states.

This means roughly two-thirds of the U.S. population (over 200 million people) have at least partial access to legal cannabis. The state of California, by itself, has a fully legal market with a larger population than Canada (39.75 million).

On paper, at least, the United States should already represent a better cannabis investment opportunity because it represents a much larger overall market.

BDS Analytics has estimated legal cannabis spending in the U.S. will reach US$12.2 billion in 2019. In Canada, even at the current rate of sales (CAD$127.3 million in August, according to StatsCan), Canada has a CAD$1.5 billion industry.

Despite this, Canada offers both cannabis companies and cannabis investors the best opportunities today. Why?

Even with overly restrictive regulation in some areas, Canada provides the legal cannabis industry with a clear playing field (in comparison to the U.S.).

- Regulatory certainty allows Canadian companies to plan ahead and scale-up operations with greater confidence

- This clean regulatory environment also provides greater access to public markets, greater access to capital markets, and generates greater outside investment

While Canada’s provincial markets present some operational differences, it’s a generally homogenous regulatory landscape. This allows greater certainty in planning for everything from cultivation operations and R&D to product development and retailing.

It’s perhaps even more important from the perspective of corporate finance. U.S.-based companies have struggled to raise capital (within the U.S.). Canadian companies, until recently, were awash in investor capital.

Most of the U.S.-based companies that have a public listing have had to come to Canada for their primary listing. U.S. trading for most of these companies is only available on the OTC.

This cleaner regulatory picture is also more attractive to large corporations seeking to enter the cannabis space. The biggest publicity has come with the investments of multinational beverage giants.

Constellation Brands (US:STZ) has invested twice in Canopy Growth (US:CGC / CAN:WEED), with the second investment totaling $4 billion. Molson Coors (US:TAP) has entered into a joint venture with Quebec-based HEXO Corp (US:HEXO / CAN:HEXO).

However, other prominent multinationals have also entered the cannabis sector – via major investments in Canadian cannabis companies. Tobacco giant Altria (US:MO) invested $1.8 billion in Cronos Group (US:CRON / CAN:CRON). More recently, groceries and convenience store multinational, Alimentation Couche-Tard (CAN:ATD.A / US:ANCTF) invested in Canadian cannabis retailer, Fire & Flower Holdings (CAN:FAF / US:FFLWF).

Couche-Tard’s initial strategic investment was only CAD$26 million. But the Company announced in the release that over the longer term it was prepared to commit up to CAD$380 million in “growth capital”.

Conversely, the largest outside investment in a U.S.-based cannabis company, was the $3.4 billion invested in Acreage Holdings. This was by a Canadian cannabis company – Canopy Growth.

Canopy may not remain a “Canadian” company due to Constellation’s dominant position. Technically, however, the largest investment in the U.S. cannabis industry was by the Canadian cannabis industry.

Holding back Canada’s cannabis industry to date has been reluctance and incompetence from some Canadian provinces in licensing cannabis stores. However, after a slow start, there are now more than 700 licensed cannabis stores across Canada, according to data from a new Echelon Wealth Partners report (Stores Wanted: The Need For Cannabis Retail In Canada).

Canada’s largest provincial markets (Ontario and Quebec) are still woefully under-serviced with legal cannabis retail stores. But the Canadian market as a whole has now reached a critical mass, led by Alberta – with 306 retail outlets.

This is translating into robust growth in cannabis sales, despite provincial failures. Canada’s legal cannabis industry tripled in size over Year 1 of full legalization. Monthly cannabis sales are now consistently growing at a double-digit pace.

Now Phase 2 of legalization is here. “Cannabis 2.0” brings a wide array of cannabis derivative products: concentrates, edibles, and infused beverages. It is expected to add 3 million new consumers (roughly a 50% increase) as well as many more female cannabis consumers.

The current fundamentals are now extremely positive for the Canadian cannabis industry. Already, some companies are making the transition to profitability.

However, what really emphasizes Canada’s position as the premier jurisdiction for cannabis investment is future potential. Echelon Wealth Partners has more data to offer here.

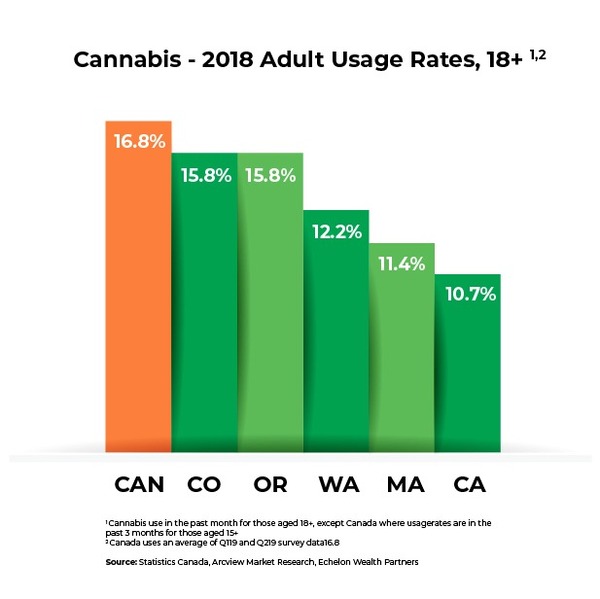

It starts with higher cannabis consumption rates. Though several U.S. states moved to full legalization well ahead of Canada, Canadians have a higher rate of cannabis consumption than even the most pro-cannabis states.

This means into extra revenue dollars being on the table in Canada today, per capita. It means even greater future potential in the Canadian marketplace.

Here Alberta’s cannabis market is illustrative. As noted, this province has greatly outpaced any other province in licensing and opening cannabis stores. At one point, Alberta had as many retail outlets as the rest of Canada combined.

This greater access to legal cannabis is already generating a dramatic increase in the rate of cannabis use in that province. In just one year, Alberta’s individual consumption rate has jumped from 16% to 20% of the population. That’s a 25% increase in the consumption rate over 12 months.

In other words, the more exposure that Canadians get to legal cannabis, the more they like it. This duplicates what is being seen in Colorado, the U.S.’s most mature (and successful) cannabis market.

Colorado is in its 6th year of full legalization. But it has set new monthly records for cannabis revenues in four of the last five months.

That’s the demand side of the equation. The untapped potential is much more dramatic when we look at supply. With the cannabis black market still controlling 85% of sales, the legal market is just the tip of the iceberg today.

Even with more than 700 cannabis retail stores in Canada, the retail footprint for cannabis is dwarfed by retail alcohol. There are roughly ten times as many retail outlets selling alcohol compared to cannabis, according to Echelon Wealth Partners.

As The Seed Investor has previously noted, cannabis has nearly unlimited commercial potential as an alcohol substitute. It is much safer than alcohol, produces none of the undesirable side effects, and consumers are already migrating aggressively from booze to pot.

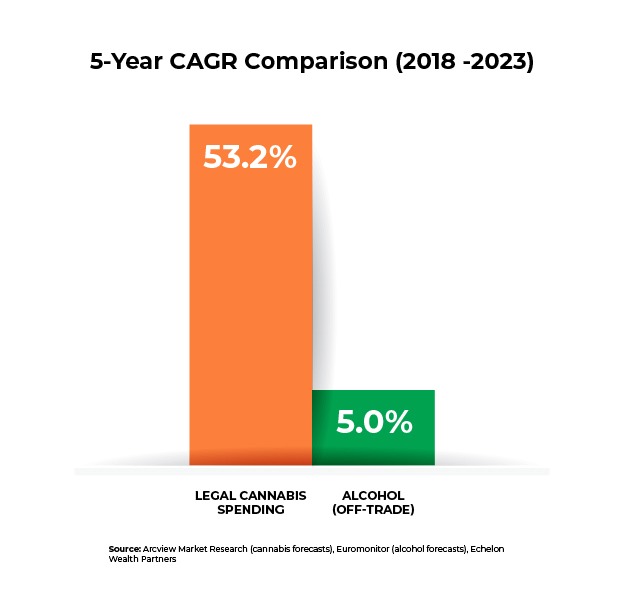

This, among other reasons, is why unit sales of alcohol are now in decline. The projected CAGR for the alcohol industry falls short of even official inflation numbers.

Legal cannabis has over ten times the projected growth rate.

Combine this with the additional cannabis distribution for medicinal purposes. Over the long term, there is no reason that the Canadian cannabis industry could not have an equal or larger retail footprint than retail alcohol.

That spells (long term) a ten-fold increase in cannabis retail stores. In turn, it is this increased retail footprint that is necessary to claim that 85% market share from the cannabis black market.

Even in the small fragment of this market that currently exists, Canada’s leading retailer, National Access Cannabis (CAN:META / US:NACNF) is moving to profitability. As Canada’s cannabis retail sector scales up, other retailers will follow.

There are more overall dollars on the table today in the U.S. cannabis industry than in Canada. Undoubtedly this will hold true going forward.

However, regulatory uncertainty and a generally unfriendly corporate environment has made it very challenging for publicly listed companies to capture these revenue streams efficiently.

Positive regulatory movement can dramatically change these dynamics. But as we’ve seen in Canada, even after the laws are passed, it takes longer than expected (due to regulatory inertia) to capitalize on commercial opportunities.

There is no way the U.S. cannabis industry can (or will) pass the Canadian cannabis industry overnight. Indeed, even with the hemp industry, which is fully legal in the U.S., farmers are having enormous difficulty selling their crops. This is because the glacier-slow U.S. government has yet to create a commercial framework for this new industry.

Canada’s stronger domestic market (and national legalization) also makes it much easier for Canadian-based companies to capitalize on growing international opportunities in cannabis. Europe and Central/South America are already starting to yield commercial opportunities.

The picture for Canadian cannabis stocks today looks grim, with valuations having retreated to greater than two-year lows. The picture for the Canadian cannabis industry is extremely bright.

Investors take note.