The Big Picture.

That’s where savvy investors start when they want to wrap their heads around an investment opportunity. The Big Picture for the global cannabis industry is enough to make any investor salivate.

The details beneath the headline are equally fascinating.

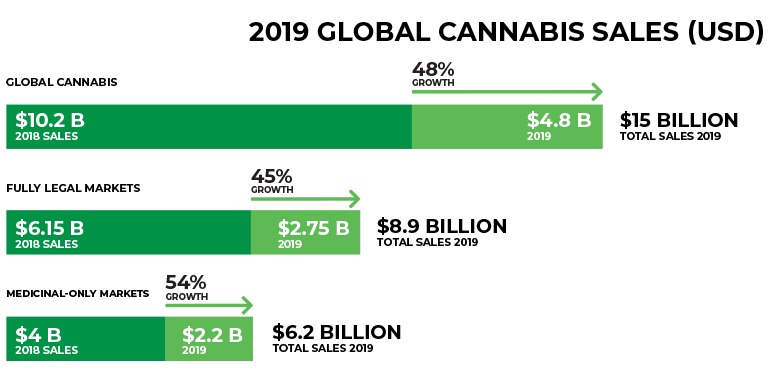

[source: Arcview/BDS Analytics]

Now consider this. All sorts of pseudo-analysts and mainstream media muppets have been shouting from the rooftops that…

These Chicken Littles have been running around shrieking that “the sky is falling” on the legal cannabis sector in a year where global sales rose by 48%.

And the cannabis industry is still literally in its infancy.

In the United States, which generated 81% of total cannabis revenues in 2019, medicinal cannabis is only legal in 33 states (~ 2 out of 3). Cannabis is only fully legal in 11 states and two of those states – Michigan and Illinois – just began legal sales in the last 7 weeks.

In Canada, the fully legal market is only one year old, and “Cannabis 2.0” products (edibles, concentrates and infused beverages) only started appearing on store shelves in the last month. These products are sales growth leaders in cannabis-legal U.S. states.

Clueless pundits who know absolutely nothing about either cannabis or the cannabis industry have been relentlessly attacking the emerging cannabis sector throughout 2019, as sales grew by 48%.

Beyond ridiculous. Completely irresponsible. Totally incompetent reporting. Investors need to simply ignore all these cannabis-bashing lightweights.

For investors who live in the real world, the legal cannabis industry remains one of the strongest if not the strongest growth sector in the global economy today.

Meanwhile, less than 10% of the global population even has access to medicinal cannabis as cannabis Prohibition is gradually put to death. The legal cannabis industry will be a high-growth story not merely for many years, but for many decades.

Consider some of the anecdotes from the spectacular growth of legal cannabis in 2019.

- Massachusetts generated over US$400 million in the first year of adult-use cannabis in that state

- Alberta, Canada’s leading province, opened over 300 cannabis stores in the first year of legalization, generating CAD$141 million in sales – just from dried flower, in a market of only 4 million people

- Florida generated total cannabis sales of over US$650 million in 2019 in a market only legalized for medicinal sales

As good as 2019 was for growth in the legal cannabis industry, 2020 stands to be an even stronger year.

In Illinois, cannabis stores racked up $19.7 million in sales in just the first 12 days of legal cannabis sales commencing January 1, 2020. This was despite widespread product shortages as demand greatly exceeded supply.

This projects to $600 million in sales in Year 1 of fully legal cannabis in that state.

In Canada, Cannabis 2.0 has arrived. Edibles, concentrates, infused beverages and tinctures became legal as of October 17, 2019. But these products are only now starting to appear on store shelves in significant quantities.

These new products are expected to lure an additional 3 million consumers to the legal market, translating into nearly a 50% increase on the current consumer base. As new products and new consumers enter Canada’s legal cannabis market, the licensing of cannabis stores is also finally ramping up.

Ontario, Canada’s largest province (population 14.5 million) has completely restructured its licensing of cannabis stores. This should result in cannabis stores multiplying in that province by roughly a factor of 10 in 2020 – from the meager current total of 25.

For these reasons, while the U.S. will continue to lead the cannabis industry in revenue growth in 2020 (in absolute terms), we see Canada’s legal market generating much stronger percentage growth this year.

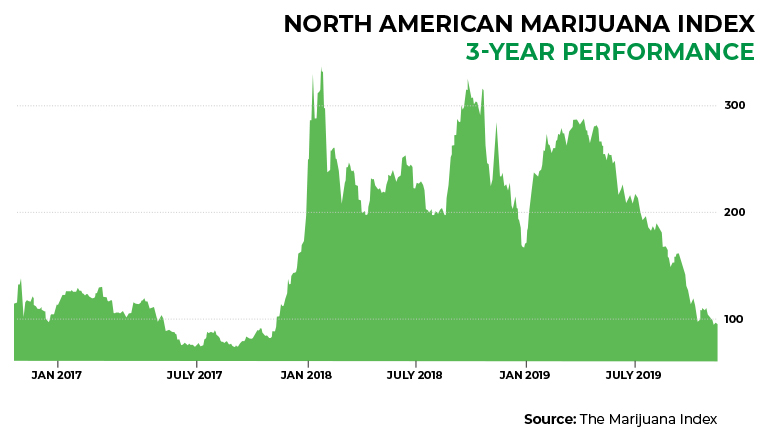

While global cannabis sales spiraled higher in 2019 (and prospects are even brighter in 2020), marijuana stock valuations have been plummeting straight down.

Stocks have retreated to greater than two-year lows, in an emerging industry that boasts year-over-year revenue growth of 48%. One of the greatest disconnects in the history of investing.

For these reasons, we’re calling 2020 The Year of Opportunity in the cannabis space.

The Seed Investor likes Canadian extraction specialists like The Valens Company (CAN:VLNS / US:VLNCF) and MediPharm Labs (CAN:LABS / US:MEDIF). We’re also bullish on Canadian cannabis retailers, including Fire & Flower Holdings (CAN:FAF / US:FFLWF), Meta Growth (CAN:META / US:NACNF), and Choom Holdings (CAN:CHOO / US:CHOOF).

In the U.S., industry leader Curaleaf Holdings (CAN:CURA / US:CURLF) is already up roughly 60% from its November 2019 low (currently trading below CAD$9). The stock has plenty of room to run, just to return to its 2019 high of CAD$15.75.

Multi-state operators like Green Thumb Industries (CAN:GTII / US:GTBIF) and Cresco Labs (CAN:CL / US:CRLBF) are well-positioned to capitalize on the explosive new cannabis market in Illinois. iAnthus Capital (CAN:IAN / US:ITHUF) is another diversified MSO that offers a strong value proposition, while specialty retailer Planet 13 Holdings (CAN:PLTH / US:PLNCF) is targeting just the leading urban markets in the U.S.

Over the longer term, with 90+% of Americans now supporting the legalization of (at least) medicinal cannabis, national cannabis legalization in the United States is inevitable. The Cannabis Revolution cannot be stopped.

While North American cannabis markets take off, international cannabis markets are just starting to materialize. Germany, Australia and Columbia are already generating cannabis revenues. Brazil just legalized medicinal cannabis – for its population of over 200 million people. Mexico is in the final stages of fully legalizing cannabis.

The cannabis sector is growing rapidly. The cannabis story has just begun. That’s the Big Picture.

As with any epic investment opportunity, those entering early stand to reap the biggest gains.

DISCLOSURE: Choom Holdings is a client of The Seed Investor. The writer holds shares in The Valens Company, MediPharm Labs, Meta Growth, Choom Holdings, and Curaleaf Holdings.