FLOODGATES ARE OPENED: MARIJUANA NOW LEGAL IN CANADA

Marijuana Retail Stocks Lead Charge

- The Race Is On - World’s top marijuana companies sent scrambling for stake in $22 billion marijuana growth industry

- Leading The Way - Seed Investor “ALERT” For Choom Holdings (OTCQB: CHOOF / CSE: CHOO)

- Big Money Backing - Leading marijuana company makes massive investment into marijuana retail chain Choom Holdings

The biggest and most lucrative race in legal marijuana has only just begun.

Marijuana is now legal in Canada and Canada’s top marijuana companies are scrambling to build out retail sales channels.

Choom Holdings (OTCQB: CHOOF / CSE: CHOO) is an early leader in this exact space and on its way to expanding its lead with a direct investment from Aurora Cannabis (ACB).

Aurora Cannabis has emerged as a Canadian marijuana powerhouse.

The $8 billion marijuana company has investments all over the world and production capacity of more than 570,000 kg in Canada.

Choom was an early mover in the retail side of marijuana.

Before Canada legalized marijuana, Choom was amassing retail locations in Canada and laying the foundation for a nationwide chain of marijuana stores.

Choom has targeted specific 39 retail opportunities with more on the way. They have also entered the US market.

The two of them together are a perfect match.

Aurora has the supply. Choom has the distribution.

The major investment into Choom by Aurora will allow Choom to ramp up it’s aggressive expansion plans.

But it’s just the start of one of brightest marijuana stories just starting to play out right now.

THE NEXT GREAT LEAP IN MARIJUANA STARTS HERE

The future of marijuana are the companies building brands, retail networks, and customer bases.

Now that marijuana is legal in Canada, retail is where the big money is going to be made.

Investors looking get in on the marijuana industry’s major must focus on marijuana retail stocks.

It’s a simple situation really.

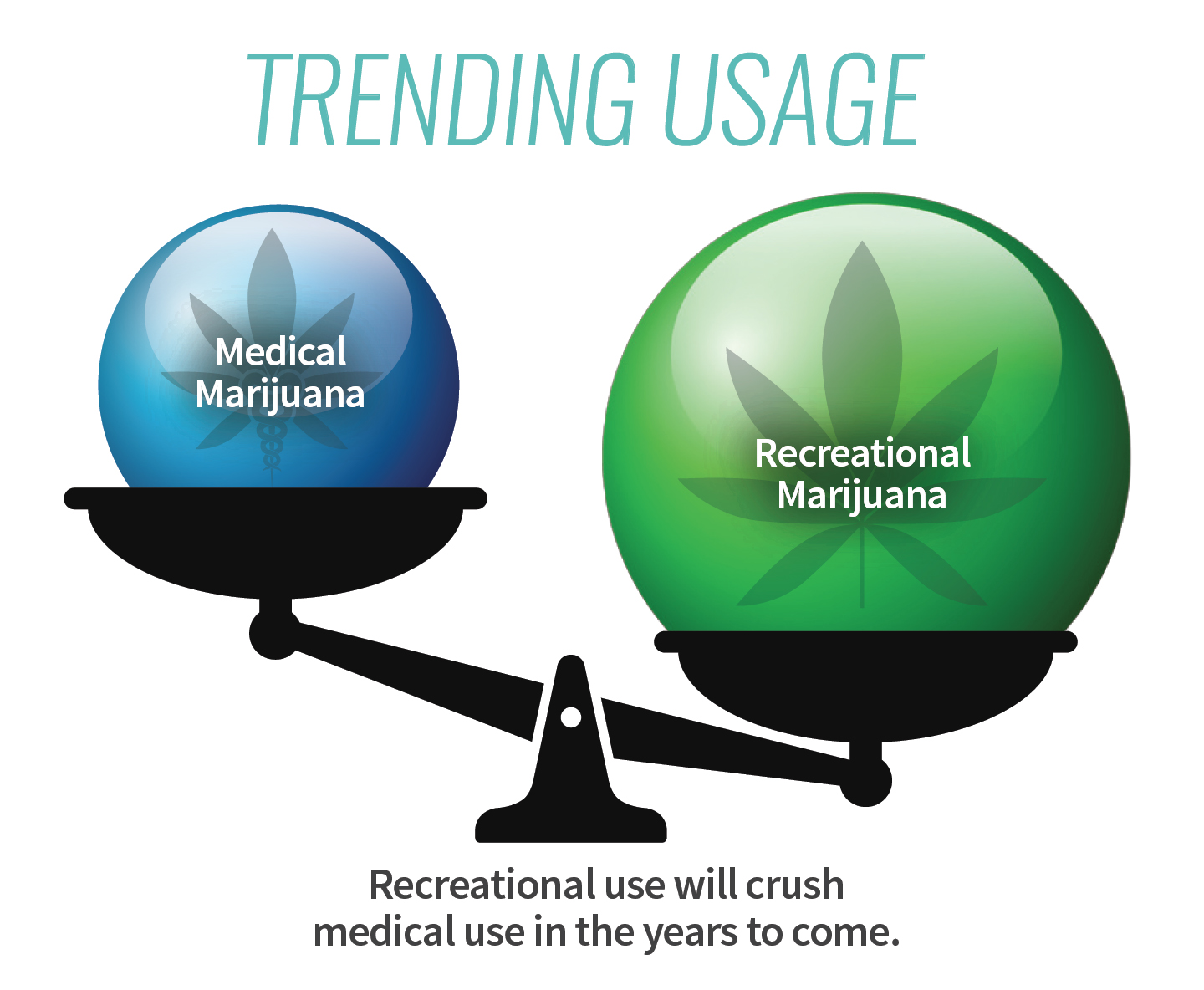

Recreational users far outnumber medicinal users.

Medicinal users have to go to a doctor, get a prescription, and jump through so many hurdles.

Recreational users, on the hand, have to do none of that.

They must go to a store and buy just like any other regulated product like alcohol or tobacco.

If you’re looking for the market worth tens of billions of dollars, it’s the recreational use market.

Now here’s the best part of all, since recreational use marijuana was just legalized, the recreational market is still in the earliest possible stage of development.

That means it’s a huge opportunity to establish market-leading positions like the Seed Investor’s top marijuana retail pick, Choom Holdings (OTCQB: CHOOF / CSE: CHOO).

A MARIJUANA RETAIL GIANT IN THE MAKING

Choom Holdings is a company purpose-built for Cannabis Retail.

Choom has taken an early lead in that race and, with the backing of Aurora, will likely expand that lead in the weeks and months ahead.

For over a year Choom has been building a marijuana brand establishing a loyal customer base of high-end legal marijuana users.

Choom’s luxury brand of marijuana brings the inherent reputation of Hawaiian marijuana (known locally as “Choom”) to a consumer focused on high-quality and high-end experience.

It currently has 39 retail opportunities in Canada covering more than 70% of the available private retail market for marijuana and has more applications pending for retail opportunities throughout the rest of Canada.

Choom recently entered an LOI with one of 25 winners of the Ontario Retail Lottery, allowing them to enter Canada's biggest market.

Choom has acquired 30 retail stores in Alberta, including 3 open stores.

Choom has also entered the US Market, announcing that they are making an equity investment in a New Jersey Cannabis Retailer.

Choom is in the process of building out a network of marijuana storefronts with a high-end user experience customers association with Apple stores and Whole Foods.

The high-end strategy tends to bring in customer with larger disposable incomes and generate more sales per square foot of retail space than some of North America’s largest retailers.

Choom is positioned to provide an essential end-of-the-line retail sales foundation for marijuana producers.

That’s why Choom – and its aggressive growth strategy – has and will be to major marijuana producers like Aurora Cannabis.

THE WINNERS IN GOVERNMENT-RUN MARIJUANA

Any way you look at it, Choom was going to be an ideal position with Canada’s legalization now complete.

It’s a marijuana retailer right at the birth of the marijuana retail industry.

They don’t get much better than that.

However, there’s another aspect which gives Choom a more important (and lucrative) role in Canada’s legal marijuana industry.

It’s all courtesy of the Canadian and provincial governments.

Regulators have put extreme limitations on how direct sales from marijuana producers to consumers.

The most populated provinces – and biggest markets for legal marijuana -- have set up a system where a central government-run distributor is a common middleman.

The system was set up this way to clamp down on producers circumventing the central government-run distribution hub and going to direct to consumers.

As you might expect, this put a major dent on the free-for-all the top marijuana producers were hoping to see.

At the same time, it makes companies like Choom with a focus on building a network of end-user retail stores filled with its branded products more valuable than ever.

And that’s why major deals like the one between Aurora and Choom become increasingly essential to the growth of legal marijuana in Canada.

THE SECRET TO OUTSIZE POT STOCK PROFITS IN 2019

The lack of recreational use market focus is a major and growing problem for legal marijuana companies in Canada.

Likewise, the situation is a major opportunity for upstarts like Choom Holdings (OTCQB: CHOOF CSE: CHOO) too.

The recreational market is too big and too lucrative for marijuana companies to miss out.

And branded marijuana companies are the future of the legal marijuana industry.

In Colorado, where recreational marijuana has been legal for years, is seeing the biggest growth in marijuana brands.

In fact, a study of Colorado’s marijuana found that in late 2016 over 40% were branded in the way that Choom Holdings is developing its own high-end marijuana brand.4

That market share was a 260% increase from the year before.4

It’s easy to see marijuana’s breakneck growth where it’s been legalized. But the hard numbers show the truly booming growth is in branded marijuana products.

The largest legal marijuana companies have realized this major change coming to the marijuana industry and they’re taking big steps to ensure they are in on it too.

In January of 2018 Aphria Inc, one of the three largest Canadian marijuana companies, announced it was going to acquire Broken Coast Cannabis Inc.

The deal would give Aphria direct access to the Vancouver Island market where Broken Coast has an established presence.

What’s really important with this deal is that Aphria paid $230 million just to get its hands on the Broken Coast brand. (http://theseedinvestor.com/cannabis-news/aphria-strengthens-portfolio-with-acquisition-of-leading-west-coast-producer-broken-coast)

It’s the perfect example of how valuable recreational marijuana brands are becoming and how desperate the major marijuana companies are to acquire them.

Choom Holdings (OTCQB: CHOOF CSE: CHOO) at around $0.50 a share are a fraction of the value of Broken Coast.

However, Choom is on a path to build up to or might even surpass Broken Coast when the recreational marijuana market opens up.

Marijuana brands are getting incredibly valuable and big marijuana companies are paying top dollar to get them.

We’ve already seen this with Choom, as large, well-established medical marijuana companies have stepped up to the plate to invest in Choom’s growing recreational brand.

- AURORA: 2nd largest Cannabis Company in Canada: $27 MILLION INVESTMENT INTO CHOOM

-ABCANN: $130 MIllion in Cash, Quality Producer: Supply Agreement with Choom

It’s important to note, investors are profiting big by betting on companies like Choom Holdings (OTCQB: CHOOF CSE: CHOO) which are developing brands too.

JUMP ON THE NEXT LEG OF THE MARIJUANA BULL NOW

History has proven over and over again, that if you’re not in before the market realizes how valuable this small subsector of marijuana stocks will be, you’re going to be left out altogether.

You don’t have to be left out again!

The legal marijuana industry is about to go through its most significant change since the 2016 elections kicked off the current marijuana boom.

The opportunities created for investors will be just as significant as the changes.

The recreational use market is set to unleash a tidal wave of demand, sales, and investment in retail marijuana companies with established brands.

And the few companies like Choom Holdings (OTCQB: CHOOF| CSE: CHOO) are in position to take advantage of it all.

Many branded marijuana companies have already run up big or have been acquired for hundreds of millions of dollars.

Choom Holdings (OTCQB: CHOOF | CSE: CHOO) is just at the start of its run.

Best regards,

The Seed Investor

FOOTNOTES

1. https://www.canada.ca/en/health-canada/services/publications/drugs-health-products/understanding-new-access-to-cannabis-for-medical-purposes-regulations.html

2. Canaccord|Genuity Canadian Cannabis: Canadian Equity Research, November 28, 2016. Matt Bottomley & Neil Marouka

3. http://theseedinvestor.com/marijuana-investing/choom-cse-choo-otc-choof-to-acquire-2nd-late-stage-acmpr-applicant

4. https://www.scribd.com/document/342916429/ArcView-Group-Executive-Summary-The-State-of-Legal-Marijuana-Markets-5th-Edition

5. http://www.cannabisfn.com/choom-laser-focus-recreational-branding-legal-cannabis/

Please see full disclaimers at www.TheSeedInvestor.com applicable to all content provided by TSI, wherever published or re-published: http://theseedinvestor.com/about/disclaimer

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This release/advertorial does not constitute an offer or solicitation to buy or sell any securities or individualized investment advice. This is a native advertisement, meaning it is an informational paid marketing piece. THESEEDINVESTOR.com (TSI) makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Please review all investment decisions with a licensed investment advisor. TSI receives payments ranging from approximately $25,000 to $150,000 to publish and/or distribute advertisements on behalf of a company. TSI retains any excess sums after expenses as its compensation. TheSeedInvestor.com and its owners, operators and affiliates may benefit from any increase in the share prices of the profiled companies. TheSeedInvestor.com may be paid for services using options or free-trading shares. TheSeedInvestor.com and/or its owners, operators and affiliates may be selling shares of stock at the same time the profile (or other information) is being disseminated to potential investors; TheSeedInvestor.com will not advise when it or its affiliates decide to sell. Investors must make all investment decisions based on their own judgment of the market and the particular securities.

This advertorial contains forward-looking statements that involve risks and uncertainties. This advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s),” “anticipate(s),” “plan(s),” “expect(s),” “project(s),” “will,” “make,” “told,” “could,” “might,” and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cause actual events or actual results of the company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein are forward-looking statements as defined in Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the company, or contained in this advertorial are not guarantees of future performance, and that the issuer’s actual results may differ materially from those set forth in the forward-looking statements. We undertake no obligation to update any statements made herein except as required by law. Differences in results can be caused by various factors including, but not limited to, the company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements.” Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. More information on the company may be found at http://www.sec.gov where readers can review all public filings submitted by the company. TheSeedInvestor.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.