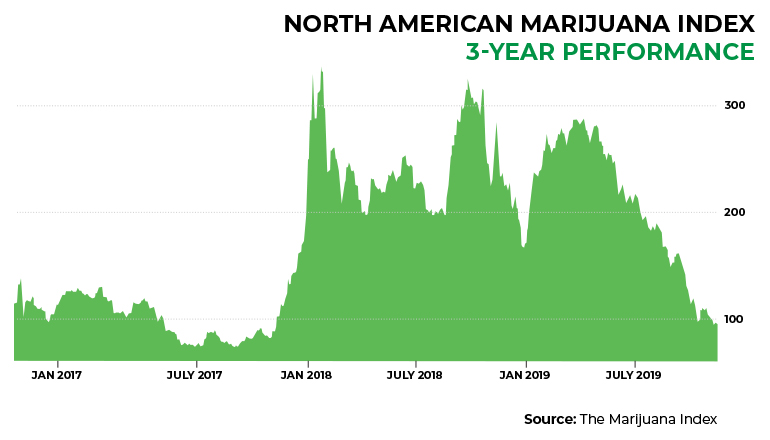

It didn’t start out that way. Marijuana stocks began the year rallying – but it was short-lived. Stocks peaked at the end of January, remained flat until March, and then commenced a sickening descent.

As the year draws to a close, this plunge in stock prices has been as irrational as it is excessive. More on this later.

As investor sentiment soured and the sector evolved, The Seed Investor started narrowing its own focus. We surveyed the cannabis landscape and settled on several investment themes.

- Lack of regulatory progress in the U.S. has precluded any broad opportunities. This limits current upside opportunities to only the strongest, best-managed companies.

- The U.S. “vaping crisis” and grossly slanted media reporting generated a totally unjustified sell-off in marijuana stocks.

- In Canada, provincial incompetence and foot-dragging in opening up cannabis stores created a supply bottleneck that seriously impaired overall revenue potential in the near term.

- This retail bottleneck (as LP’s ramped up cultivation) has led to a rise in cannabis inventories and falling margins for Canadian cannabis cultivators.

Those were the themes that attracted the most media attention in 2019. Less noticed were several positive investment drivers:

- The pending market for Cannabis 2.0 products in Canada (Phase 2 of legalization) generated an immediate need for large-scale cannabis extraction and an emerging opportunity for well-positioned cannabis retailers.

- Expertise injection: Many food-and-beverage industry management veterans flocked to the cannabis sector in 2019.

- Aleafia Health (CAN:ALEAF / US:ALEAF) reported its first outdoor cannabis harvest at cash costs below CAD$0.10 per gram, a potential game-changer for Canadian cannabis cultivation.

- In mid-December, Major League Baseball surprised many pundits by removing cannabis as a “banned substance” for MLB players. Other professional sports leagues are expected to follow.

- Even with the irrational sell-off, several cannabis winners emerged in 2019.

- A large capital infusion is coming soon to the industry

- The US “vaping crisis” is subsiding, even as we finally learn more about the causes

In the United States, the lack of further regulatory progress at both the federal and state level has severely undercut the U.S. cannabis industry in 2019.

Virtually nothing was accomplished at the federal level this year. The much-touted SAFE cannabis banking bill that would open up banking services for legal cannabis companies now appears stalled in the Republican-controlled Senate.

At the state level, fewer states than expected moved to legalize cannabis. Compounding this, many states with already-legal cannabis markets continue to torpedo the legal cannabis industry with legislative and bureaucratic idiocy. Here California is the Poster Child.

The U.S. “vaping crisis” represents one of history’s most-absurd market disconnects.

Thousands of Americans developed serious respiratory illnesses from black market cannabis vaping products (and dozens have died). But what are the actual consequences of this media-hyped “crisis”?

It puts much more pressure on the U.S. federal government to nationally legalize-and-regulate cannabis – to protect Americans from these tainted illegal products.

Support for cannabis legalization among Americans hasn’t waned. This is despite all the irresponsible media reporting. Mainstream pundits attempted to portray this as a general problem for not only the U.S. cannabis industry, but even the Canadian cannabis industry – for which this has no impact whatsoever.

Sales for U.S.-based cannabis companies have been largely unaffected. So where was (is) the justification for the massive sell-off in U.S. marijuana stocks? There isn’t any.

2019 Cannabis Winners

Yet even in this extremely challenging environment for U.S.-based cannabis companies, some of the strongest, best-positioned companies still had very successful years – and generated net gains in 2019.

In our Marijuana Stock Winners in 2019, we pointed to three popular U.S.-based companies that produced positive returns for investors.

Curaleaf Holdings (CAN:CURA / US:CURLF) is the world’s largest cannabis company by revenues. It’s a broadly based MSO that is approaching profitability. Investors selling at the 2019 high could have reaped more than a double during the year.

Trulieve Cannabis (CAN:TRUL / US:TCNNF) dominates Florida’s large medicinal cannabis market. It’s now also moving into additional states. TRUL delivered better returns in the 2nd half of 2019 than any other major cannabis stock.

Planet 13 (CAN:PLTH / US:PLNHF) is a Las Vegas retailing powerhouse. It operates the world’s largest cannabis store. Planet 13 has been able to translate that strong positioning into an “up” year for investors.

All three are delivering positive returns for 2019. All three provided solid profit-taking opportunities over the course of the year.

The Biggest 2019 Cannabis Winners Were In Canada

While the United States clearly offers more long-term potential for legal cannabis, today the best profit opportunities remain in Canada.

However, because of provincial delays in opening up retail cannabis, we have also narrowed our focus here. In June, we began banging the drum for Canadian cannabis extraction specialists – further down the supply chain and less affected by initial retail pains.

As provincial delays in store-openings worsened, we also targeted Canada’s retailing specialists. In a market with a lack of retail stores, wholesaling opportunities for Canadian LP’s have been limited. But for those companies actually operating cannabis stores, they benefit from strong demand and (generally) high margins.

That said, the best-performing major marijuana stock in Canada (and North America) in 2019 was a Canadian cultivation specialist.

Village Farms (US:VFF / CAN:VFF), a Canadian cannabis cultivation powerhouse, had a tremendous year in 2019. Like nearly all marijuana stocks, VFF has been pushed well below its 2019 high. Even so, it’s on track to end the year at nearly double where it began 2019. Profit-taking investors could have netted more than a five-bagger with Village Farms if they sold near the high.

MediPharm Labs (CAN:LABS / US:MEDIF) is one of the two Canadian extraction specialists that The Seed Investor has been touting this year. Rapidly scaling-up extraction capacity. Very strong margins. Very strong revenue growth. Full profitability. Based on this, investors had the opportunity for more than a 300% gain in 2019.

The Valens Company (formerly Valens GroWorks) (CAN:VLNS / US:VGWCF) is Canada’s other dominant extraction specialist. Similar to MediPharm in terms of scaling-up capacity, margins, revenues, and profitability. Where the two companies differ (at the moment) is that Valens is moving towards greater vertical integration while MediPharm is busy expanding into Australia’s emerging cannabis market.

Valens is also set to end 2019 strongly higher on the year. Astute investors could have more than tripled their money in 2019 by selling VGW near the high.

What makes these 2019 winners all the more impressive is the horde of short-sellers that flocked to the cannabis industry. Egged on by the ultra-negative (and inaccurate) media reporting, short positions across the cannabis industry have swelled to extremely bloated levels.

Conversely, this over-exposure on the short side in 2019 creates enormous potential for a “squeeze” in 2020.

While Canada’s extraction specialists managed to thrive this year, Canadian retail specialists have not been able to match that performance.

We’ve focused on three of Canada’s cannabis retailing leaders: Meta Growth (CAN:META / US:NACNF), Fire & Flower Holdings (CAN:FAF / US:FFLWF), and Choom Holdings (CAN:CHOO / US:CHOOF).

With overall growth in Canadian cannabis sales below expectations, none of these three companies produced positive investor returns in 2019. But all were very active in adding to their cannabis store totals – through a mixture of acquisitions and organic growth.

Now Cannabis 2.0 has arrived. A wide array of new (and generally higher margin) cannabis products are expected to lure 3 million new Canadian consumers to the legal cannabis market. This would translate into roughly a 50% increase in the number of consumers for the legal industry.

The potential is here.

Alberta has already shown other provinces the way. With roughly 350 retail locations, by itself Alberta accounts for almost half of Canada’s 700+ cannabis stores today.

At the opposite end of the spectrum, Canada’s largest provinces (Ontario and Quebec) have been the worst performers in opening up stores. Conversely, Ontario has recently signalled that it is overhauling its dysfunctional system for cannabis store licensing in favor of an “open allocation” system.

If implemented effectively, this represents a massive upside for Canadian cannabis in general – and cannabis retailers in particular. While the stocks of these retailers have been a disappointment in 2019, we will have much more to say about Canadian cannabis retail when we publish our own take on “looking ahead to 2020.”

For cannabis investors with a strong focus on Canadian LP’s, there were also reasons for optimism despite the negative returns in 2019.

Aphria Inc (US:APHA / CAN:APHA) has now reported profitability for two consecutive quarters. Aurora Cannabis (US:ACB / CAN:ACB) posted an industry-leading Gross Profit of CAD$53.7 million and 58% Gross Margins in its most recent quarter. Despite a disappointing year, industry leader Canopy Growth (US:CGC / CAN:WEED) is up roughly 50% from its November low following a “buy” recommendation from BoA Merrill Lynch.

Even with the headwinds for U.S.- and Canadian-based cannabis companies, the take-down in marijuana stocks could not be justified by cannabis industry fundamentals.

The mainstream media claimed (over and over) that it was “lack of profitability” that pushed down marijuana stocks. This excuse doesn’t hold water.

Several Canadian cannabis companies transitioned to profitability in 2019. Along with MediPharm, Valens and Aphria, several smaller Canadian companies also achieved this.

All saw their share prices go down, not up, after they reported profitability. A massive investment disconnect.

Marijuana stocks melted down in 2019, for “reasons” that have been both exaggerated and misreported by the cannabis-ignorant mainstream media. Many positive industry developments and investment drivers were completely ignored by (so-called) analysts and are not remotely reflected in current valuations.

For these reasons, this year’s investing pain could turn into next year’s epic bull-run.

DISCLOSURE: The writer holds shares in Curaleaf Holdings, MediPharm Labs, The Valens Company, Meta Growth, and Choom Holdings. Choom Holdings is a client of The Seed Investor.