- There are now three psychedelics-based ETFs available to investors in this sector

- Each has a different orientation

- We compare and contrast the three ETFs, and offer guidance on which ETF(s) may be right for you

Advisor Shares’ psychedelics ETF, PSIL, commenced trading on Thursday on the NYSE Arca Exchange. Opening at $10.11, PSIL closed down 1.67% on the day to $9.94 This brings to three the number of ETFs targeting the emerging psychedelic drug sector.

ETFs remain popular with investors. So Psychedelic Stock Watch is analyzing these ETFs to help you determine which is the best fit for your own portfolio.

Of course, not only do investors have different investment goals and tolerances for risk. They will also have different strategic motives in purchasing units of an ETF. Generally, we can break this down into three strategies.

- Investors seeking to invest in a psychedelics ETF (or more than one) instead of holding shares in individual companies.

- Investors who are already holding psychedelic stocks and looking for an ETF that provides the most exposure to companies that they are not already holding individually.

- Investors simply looking for an ETF to compliment their individual holdings that will deliver the best near-term performance.

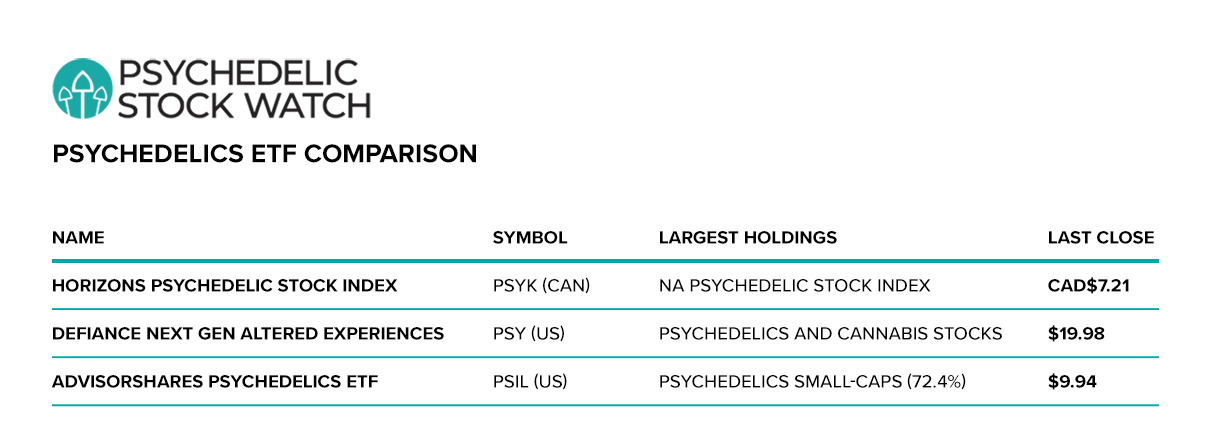

Here’s a snapshot of the three ETFs.

Horizons ETFs’ North American Psychedelic Stock Index (PSYK) was the first of these funds to launch, debuting in January 2021 on Canada’s Neo Exchange.

The Defiance Next Gen Altered Experience ETF (PSY) followed in June, commencing trading on the NYSE Arca Exchange. Now AdvisorShares Psychedelics ETF (PSIL) has provided U.S.-based investors with a second ETF option.

PSYK Horizons NA Psychedelic Stock Index

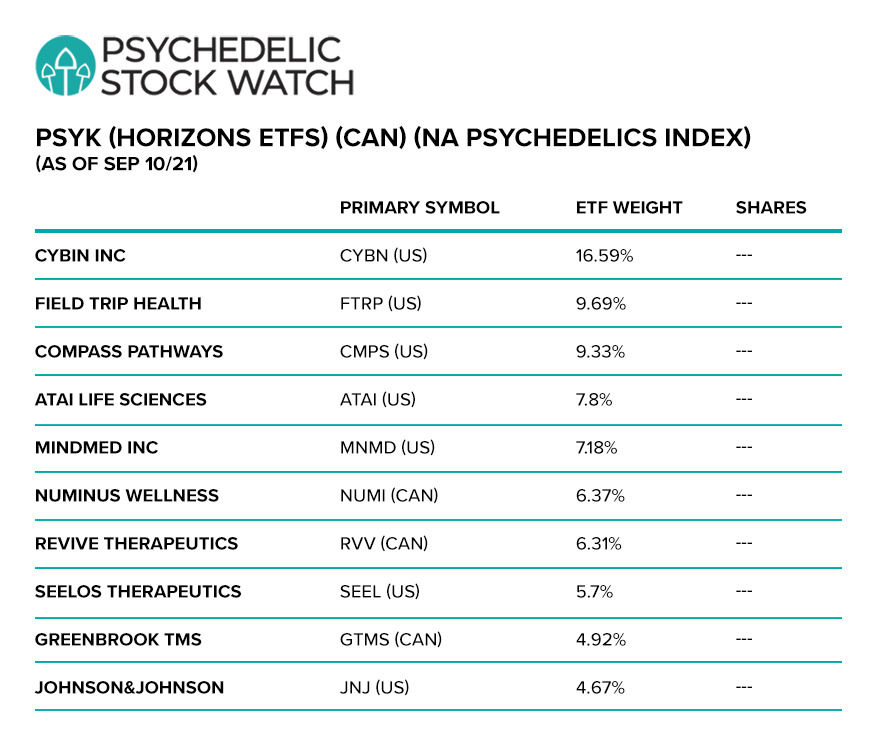

PSYK is a straight index fund of leading North American psychedelics stocks listed in either the U.S. or Canada. Still less than a year old, the fund doesn’t yet track performance data in accordance with securities regulations.

With just ten stocks in the index, PSYK provides the most-concentrated exposure to these stocks, both in terms of overall concentration and its three largest holdings. Cybin Inc (US:CYBN / CAN:CYBN) (16.59%), Field Trip Health (US:FTRP / CAN:FTRP) (9.69%), and Compass Pathways (US:CMPS) (9.33%) collectively account for over 1/3rd of the total index.

While more concentrated than the other ETFs, it may also be looked at as the most-conservative of the three, with the index heavily weighted toward the larger companies in the psychedelic drug industry.

Five of the largest companies in the sector, Cybin Inc, Field Trip, Compass Pathways, atai Life Sciences (US:ATAI) and MindMed Inc (US:MNMD / CAN:MMED) are the top-5 holdings in the index and collectively account for over 50%. Throw in the 4.67% weighting of Big Pharma’s Johnson & Johnson (US:JNJ), and that brings the index’s weighting in larger stocks to 55.26%.

This makes the fund a good vehicle for what Horizons intended (as the first of the psychedelics ETFs): a conservative fund that would provide a relatively safe entry point for new investors into a brand-new (and speculative) sector. The holdings are regularly rebalanced.

As the sector matures, it continues to fulfill that function. For more experienced investors in the sector who may have their holdings focused on some of the smaller, high-growth prospects, PSYK could also be a hedge to provide some performance stability in their psychedelics portfolio.

Available to U.S.-based investors under the symbol HSPYF, PSYK will likely remain a popular option among psychedelics investors.

PSY Defiance Next Gen Altered Experiences ETF

PSY is the first U.S.-listed psychedelics ETF, although it is actually a combination psychedelics/cannabis ETF. Roughly half of the 20 holdings in the fund are primarily cannabis companies.

Defiance limits investments in the fund to companies with a minimum market cap of $75 million. Given the compressed valuations of psychedelic stocks in 2021, this means that many popular psychedelic small caps are not even eligible (at present) to be held in PSY.

With its restriction to larger companies, PSY is also a relatively conservatively oriented fund. For psychedelics investors who don’t presently have exposure to the cannabis sector (but would like some), PSY is a strong candidate.

Conversely for investors who already have exposure to both individual psychedelics and cannabis stocks, the fund may be both too spread out and too conservative to offer the desired growth potential.

AdvisorShares Psychedelics ETF

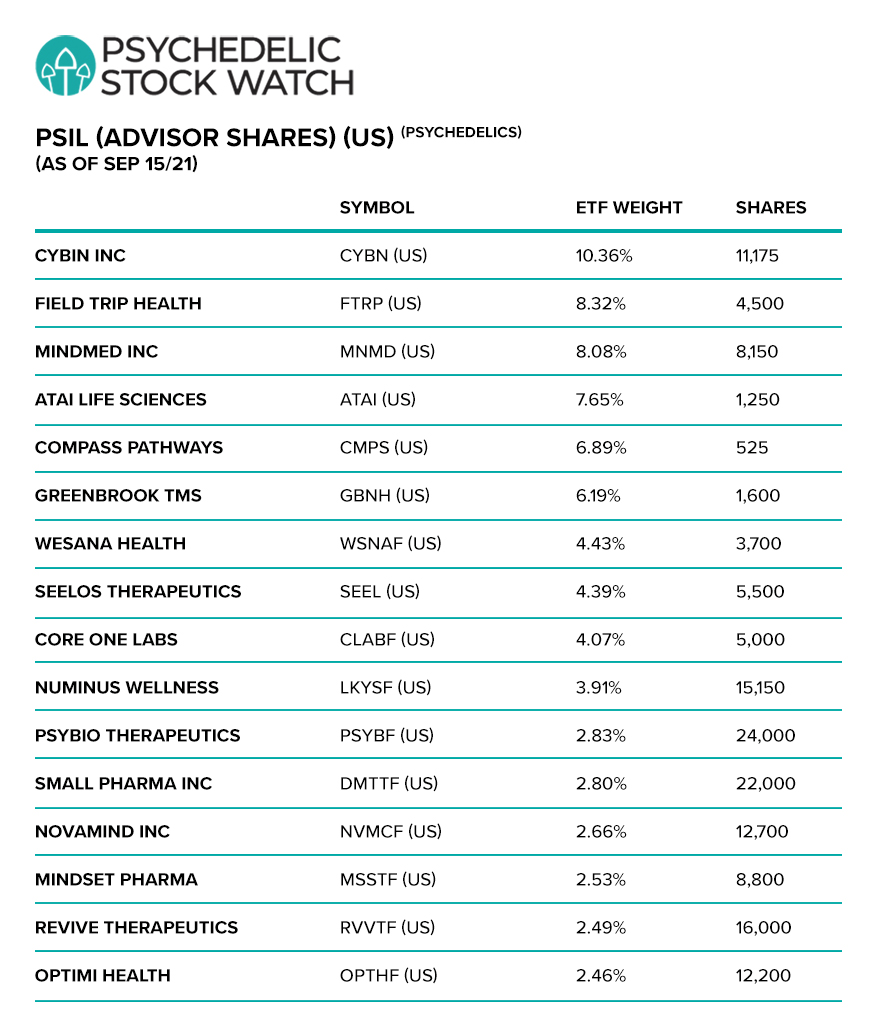

The newest of the three psychedelics ETFs, PSIL may quickly become popular among many of the more experienced investors in this sector. Why?

Small-cap exposure.

The fund officially lists its exposure to small caps at 72.4% among its 16 holdings (as of September 15, 2021).

This actively-managed fund provides significant exposure to the three industry leaders in the psychedelic drug industry: atai, Compass and MindMed (22.58% combined). However, the remainder of holdings are dedicated to the smaller companies in this emerging sector. The management fee of 0.60% is certainly reasonable.

Initial exposure in the fund focuses on Cybin and Field Trip (along with the three larger players), However, as brand-new fund, PSIL is currently sitting with 19.94% in cash.

Prominent smaller holdings in the fund include Greenbrook TMS (CAN:GTMS/ US:GBNH) (6.19%), Wesana Health (CAN:WESA / US:WSNAF) (4.43%), and Core One Labs (CAN:COOL / US:CLABF) (4.07%).

With the fund debuting at a time of very compressed valuations in the sector and with its high-growth focus on small caps, even more experienced investors in psychedelic stocks may look to take a position in this ETF. This is especially true for investors who are currently lacking exposure to some of PSIL’s larger holdings.

Holding more than one psychedelics ETF?

As already noted, psychedelics investors looking for additional exposure to cannabis stocks may see PSY as being very complimentary to their portfolio. Conversely, for those not wanting more cannabis exposure, PSY likely has little appeal.

Those investors buying into PSY may also want to consider PSIL. This would add significant exposure to psychedelics small caps, to go along with the cannabis stocks and larger psychedelics stocks. Holding PSYK along with PSY is likely not an attractive option for most investors – given the conservative orientation of both and significant overlap in holdings.

For investors already holding PSYK, adding a position in PSIL may also be attractive. As noted, PSIL provides much greater small-cap exposure than PSYK. Even with the overlap in holdings between the two funds, the combination of the two ETFs should provide more upside growth potential than PSYK alone.

New investors to the sector may also see the PSYK/PSIL combination as being attractive. The overall combination is still fairly conservatively weighted. However, the broader exposure to small caps (via PSIL) provides new investors to the sector with a stronger growth component.

Balancing holdings between the two ETFs becomes a function of risk tolerance.

The growth in the number of psychedelics-based ETFs is another indicator of both the growing popularity and growing legitimacy of this emerging industry. It adds to an expanding list of indicators of the industries popularity/legitimacy:

- The vast sums of capital being poured into the sector by institutional investors for psychedelic drug R&D.

- The explosion in (favorable) media coverage on the potential of psychedelic medicine to revolutionize mental health care.

- Increasing analyst coverage of psychedelic stocks and the presence of many high-profile investors, representing both Silicon Valley and Wall Street.

Of course, all this enthusiasm for psychedelic drugs is based upon both the enormous need for psychedelic medicine and its incredible commercial potential.

Two billion people globally have treatable (but generally untreated) mental health disorders. Advanced research on psychedelic drugs is already targeting treatment markets with a commercial value of $330 billion.

Yet current valuations in psychedelic stocks are low.

A great time to launch a new psychedelics ETF. A great time for investors to add to their holdings in this emerging sector.

DISCLOSURE: The writer holds shares in Cybin Inc and MindMed Inc.