- Psychedelic drugs are pioneering a healthcare Revolution in numerous, badly-underserved multi-billion-dollar treatment markets

- We compare the strengths and weaknesses of six of the leaders in psychedelic drug R&D among public companies

Drug R&D in the emerging psychedelic drug industry continues to advance. Share prices continue to lag.

With these two dynamics in mind, Psychedelic Stock Watch saw this as an opportune time to compare drug development opportunities among the public companies in this sector.

The opportunity in psychedelic drug development

For investors new to the psychedelic drug industry, the commercial upside to psychedelic drug development is enormous. We have previously laid out the parameters here.

Perhaps even more important is the urgency of psychedelic drug development. A Mental Health Crisis has now deteriorated into a full-fledged pandemic. Psychedelic drugs are mental health “miracle drugs” that represent the only near-term hope of coping with this pandemic.

Public companies pursuing these enormous drug development opportunities are generally well-capitalized. Yet despite the magnitude of the opportunity, most of these companies sit with very compact valuations.

We look at six of the public companies with the most-advanced psychedelic drug R&D. And we highlight the strengths and weaknesses of each.

In evaluating these drug R&D candidates, we examined the following factors.

- Stage of research

- Number of advanced drug candidates

- Market cap and capitalization

- Commercial potential

Compass Pathways (US:CMPS)

Compass Pathways is the obvious place to start in looking at drug development opportunities in the psychedelic drug sector – for several reasons.

The most-advanced drug R&D candidate among public companies (COMP360)

Received Breakthrough Therapy Designation from the FDA

Well-positioned research (Treatment-Resistant Depression)

One of the best-capitalized pubcos

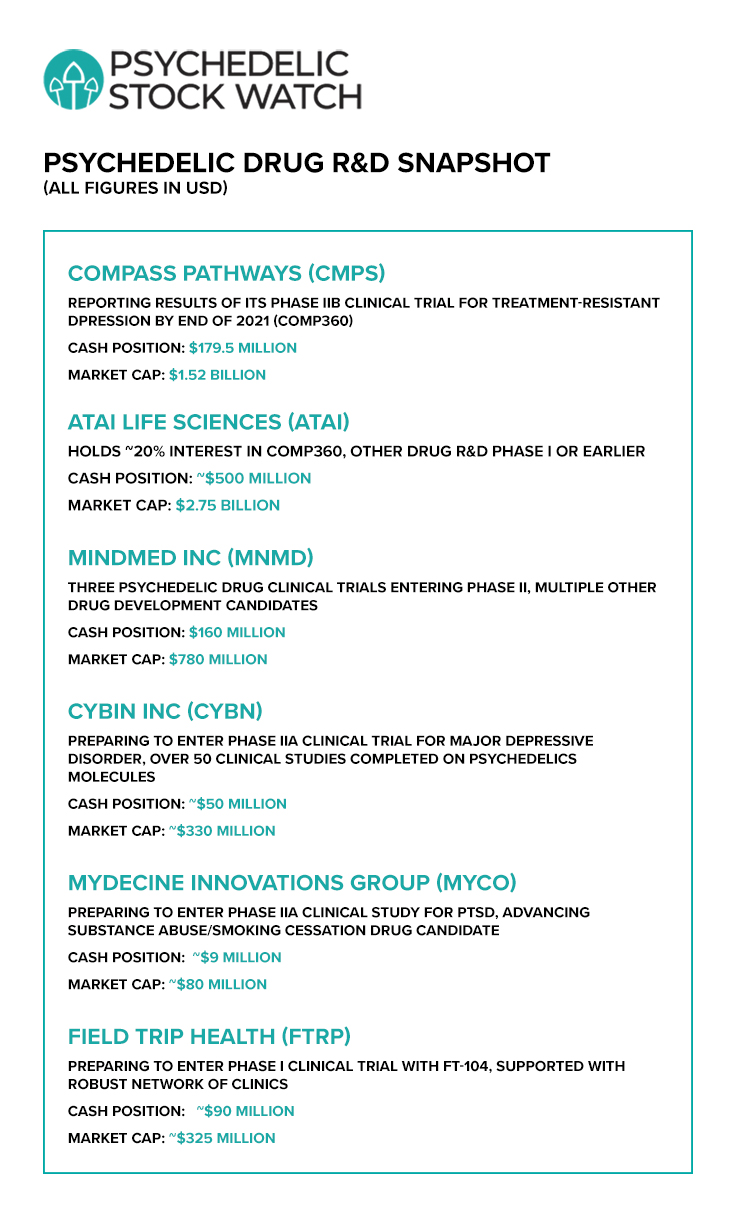

Compass recently announced completion of its Phase IIb clinical trial of a psilocybin-based drug therapy for Treatment-Resistant Depression. Results for the study are expected by year end.

Strengths:

As noted, Compass’ lead drug candidate (COMP360) boasts several advantages over its peers: advanced, expedited and well-positioned research. Treatment-Resistant Depression offers especially robust commercialization potential as it is a strong candidate for health insurance coverage, in a multi-billion-dollar medical treatment market.

With a cash position of $179.5 million (as of March 31, 2021), CMPS is amply capitalized to take COMP360 through Phase III of the clinical trials process. Its NASDAQ listing provides investors with maximum exposure/liquidity.

Weaknesses:

Beyond COMP360, Compass Pathways does not have much depth in its drug R&D pipeline. While even one drug success can be a company-maker in the pharmaceutical industry and COMP360 is showing great promise, success is not yet assured.

If COMP360 doesn’t successfully advance to the finish-line in drug R&D, then suddenly CMPS would simply look expensive (current market cap: $1.52 billion).

atai Life Sciences (US:ATAI)

With atai’s partnership with Compass Pathways (atai holds ~20% of CMPS), this alone qualifies ATAI as one of the leading drug R&D candidates. Atai’s recent NASDAQ IPO in mid-June was arguably the most-anticipated event in the industry this year.

Yet the IPO itself has been a disappointment. After a modest jump on its IPO day (+29.67%), the stock immediately levelled off, with trading volume dropping dramatically. Previously seen by many as a sure-thing in this emerging industry, atai now warrants closer scrutiny.

Strengths:

Obviously, capital is a strength with this company. Following completion of its IPO financing, atai’s cash position will be ~$500 million – more than double any other player in the industry. As noted, atai holds more than a 20% interest in Compass Pathways. With its recent IPO, atai is also NASDAQ-listed.

It's 10 corporate research partnerships provide ATAI (and its shareholders) with the most diverse platform for psychedelic drug development and related IP.

As one of the first players (and the largest) in this emerging industry, and boasting a number of high-profile investors, atai Life Sciences has had a certain mystique in the sector. However, some of this luster may have faded after its lackluster IPO.

Weaknesses:

Ironically, the industry’s most diverse company lacks much advanced drug R&D beyond CMPS. Only one of atai’s ten corporate partners is preparing to enter a Phase II clinical trial (Recognify Life Sciences). Other research is at the early, Phase I stage or pre-clinical.

Yes, atai has oodles of capital and the clear capacity to raise more. But in terms of advanced research, atai is still very much a one-trick pony.

Great potential, but as with all drug R&D (and the other tech initiatives of its research partners) the earlier the stage of research the more speculative the result.

Given its elevated market cap (~$2.75 billion), atai would look much more attractive to investors with at least one more advanced drug R&D candidate in its pipeline.

MindMed Ind (US:MNMD / CAN:MMED)

MindMed is the other clear industry leader in this emerging sector by market cap ($780 million). As one of the first public companies in this space, MindMed has advanced rapidly from a small startup in early 2020 to its present status.

Co-founder and original CEO, JR Rahn, has now left the company. Robert Barrow, a veteran of drug R&D clinical trials, is the new CEO. While much smaller than either ATAI or CMPS by market cap, MindMed’s daily trading volume is roughly equal to both – by dollar value.

What is responsible for the company’s strong popularity with retail investors?

Strengths:

MindMed’s claim to fame (and popularity with investors) is derived from one primary factor: R&D depth. Via MNMD’s research partnership with the University of Basel, Switzerland, MindMed boasts the most-advanced drug pipeline in the industry. MindMed is also collaborating with Maastricht University (Netherlands) in its ADHD research.

Three clinical trial programs are entering Phase IIa clinical trials:

- LSD for ADHD (microdosing)

- LSD for anxiety

- LSD for Cluster Headaches

MindMed also has high hopes for 18-MC, a non-hallucinogenic ibogaine-based drug to treat opioid addiction. With MindMed wrapping up its Phase I trial, the company hopes to commence a Phase IIa clinical trial for 18-MC in 2022.

MindMed is also involved in IP development, including “Albert”, MindMed’s digital therapeutics platform. MindMed has raised US$204 million since its inception, with a current cash position of US$160m (as of May 14, 2021).

As already noted, the company boasts by far the strongest retail investor following. Yet its market cap is roughly ½ that of CMPS, and only about ¼ of atai’s market cap.

Weaknesses:

For all the depth of MindMed’s R&D pipeline, it lacks a single marquee drug development initiative to match Compass Pathways’ (and atai’s) COMP360. 18-MC could become that flagship project – targeting the Opioid Crisis – but it’s (at least) a couple of years behind COMP360.

MindMed’s existing Phase II drug trials target major treatment markets, but the commercialization potential is not as clear as with COMP360. The company also has the most inflated share structure among major players in the industry with 451 million shares issued/outstanding.

Cybin Inc (CAN:CYBN / US:CLXPF)

Cybin has been one of the best-performing psychedelic stocks in 2021. As one of the companies most-heavily covered by analysts, those two factors are likely related. Since bottoming at CAD$1.21 on March 30, 2021, CYBN has traded as high as $2.75 and currently sits at $2.63.

What is the attraction for this stock to retail investors and analysts?

Strengths:

Cybin is entering a Phase IIa clinical trial of CYB001, a psilocybin-based therapy to treat Major Depressive Disorder, after receiving IRB approval in May 2021. Major Depressive Disorder actually represents a significantly larger treatment population than Treatment-Resistant Depression (COMP360).

Though not capitalized to the same degree as ATAI, CMPS or MNMD, Cybin has been one of the most successful Canadian-based companies in raising capital. Cybin has raised roughly CAD$90 million since 2019 and reported a cash position of ~CAD$64 million as of March 31, 2021.

Via its acquisition of Adelia Therapeutics (December 2020), Cybin has been rapidly expanding its R&D pipeline. The company has now completed 51 pre-clinical studies on novel psychedelics molecules, several of which have already generated positive pre-clinical results. Two deuterated tryptamines, CYB003 and CYB004 are moving toward clinical trials.

Based on these strengths, CYBN has attracted increasing analyst coverage. Most-bullish is Stifel GMP, with a CAD$15 price target on the stock. With a market cap of CAD$415 million (~US$330 million), CYBN is priced at only a small fraction of either CMPS or ATAI. The company is seeking to uplist to the NASDAQ.

Weaknesses:

Not only is Cybin’s lead drug candidate (CYB001) at least a year or so behind COMP360, but it may not have equivalent commercialization potential. Based upon how insurers determine coverage, Major Depressive Disorder may not attract the same level of coverage – a critical factor given the expense of psychedelics-based therapies.

With less capital than its larger peers (and a higher burn rate), Cybin will have to go to capital markets for new financing sooner than either ATAI, CYBN or MNMD if it seeks to continue the pace of its drug development – thus greater potential for dilution.

Mydecine Innovations Group (CAN:MYCO / US:MYCOF)

Cybin Inc is a much cheaper entry point for investors seeking access to a psychedelics-based clinical trial in/entering a Phase II clinical trial. But it’s not the cheapest alternative.

That honor belongs to Mydecine Innovations Group. The company is preparing to enter a Phase IIa clinical trial with a psilocybin-based therapy for PTSD.

Strengths:

MYCO is a diversified play in the industry, also active in IP development and psilocybin cultivation – including the first-ever international export of psilocybin mushrooms (“magic mushrooms”). And the company is broadening its drug pipeline with a new substance abuse/smoking cessation candidate.

Mydecine is waiting to receive its Investigational New Drug (IND) approval for its Phase IIa clinical trial, hoping to commence it in Q3 or Q4 of this year. PTSD generates a horrendous mental health toll, especially on combat veterans (there are 22 U.S. veteran suicides per day).

Current treatment options are grossly inadequate. This makes psychedelics-based PTSD therapy a strong candidate for insurance coverage – and a potentially lucrative commercial base.

Based on MYCO’s strengths, Roth Capital Partners has initiated coverage of Mydecine, with a CAD$3 price target (currently at CAD$0.415). With a market cap of less than CAD$100 million (~$US$80 million), Mydecine is a very cheap entry point for relatively advanced psychedelic drug R&D. Seeking to uplist to the NASDAQ.

Weaknesses:

As might be expected for a company of this size (involved in capital-intensive drug development), capital is the biggest question mark for Mydecine. After raising CAD$17.25 million in February, the company has a cash position of CAD$11.3 million as of March 31, 2021.

If the sector takes off (again), MYCO can raise capital on much more favorable terms and address this weakness. However, if psychedelic stocks remain stuck in their sideways trading pattern, shareholder dilution is a significant concern.

Also, while PTSD is a very promising research market for psychedelics, MYCO is not the first-mover here. MAPS boasts pole position in psychedelics-based PTSD research with its Phase III clinical trial well underway. However, MAPS is researching an MDMA-based therapy. Given the size of the market and magnitude of need, there would appear to be plenty of room for parallel R&D.

Field Trip Health (CAN:FTRP / US:FTRPF)

Last but not least among these six leading companies in psychedelic drug R&D is Field Trip Health. Field Trip is behind the other companies on this list in terms of the progress of its drug R&D. Lead candidate, FT-104, is expected to commence a Phase I clinical trial later this year.

However, Field Trip offers other advantages that many investors may see as compensating for the earlier stage of its drug research.

Strengths:

Field Trip is thought of by most psychedelic drug investors as a “clinics” company. FTRP has a robust and expanding network of mental health clinics in the United States and Canada – specializing in ketamine-based psychedelic drug therapy.

The only TSX-listed psychedelic stock in Canada, Field Trip is actively pursuing uplisting to the NASDAQ. Well-capitalized, the company has closed the single largest Canadian psychedelics financing, a CAD$95 million raise in March 2021 (current position: CAD$111.8 million). FTRP has also attracted significant analyst coverage.

FT-104 is described by the company as possessing “psilocybin-like pharmacology”. As Field Trip begins advancing FT-104 through the clinical trials process, its existing clinics base (and patient population) provides Field Trip with logistical/efficiency advantages in drug development versus its peers.

Perhaps equally important to many investors, as FTRP builds out its clinics network (targeting 75 treatment centers by 2024) the company expects to generate robust revenue streams. Field Trip is currently estimating revenue streams of CAD$2.5 - $3.0 million per center annually. Revenues of that m magnitude would/will go a long way in meeting drug development costs – reducing future capital needs.

Weaknesses:

In terms of drug development, Field Trip’s greatest weakness is that it is dividing its energies more than the industry players with a purer focus on drug R&D. We see this in terms of FTRP not being as far as advanced as its peers.

It’s also a factor in overall corporate development. With much of FTRP’s time and energy (and most of its capital) going into expanding its clinics network, it’s difficult to see Field Trip reaching the finish line in drug R&D as quickly as most of the companies above.

Summary

Which company is the “best pick” in psychedelic drug R&D will ultimately be a personal choice for investors. Those opting more for security and near-term R&D potential will likely gravitate toward the two largest players: atai and/or Compass Pathways.

Conversely, investors with a more long-term outlook on psychedelic drug R&D may favor MindMed or Cybin as being both more diversified than the larger players and much better value propositions. With a market cap of less than CAD$400 million, Field Trip Health also looks like a stronger value play – with the added advantage of its clinics network.

Meanwhile, small-cap investors simply looking for the drug candidate with (as of today) the most upside potential may want to take a position in Mydecine Innovations Group. Obviously, most investors with a serious interest in this sector will likely want to invest in several of the companies above.

These six leading psychedelic stocks in drug R&D offer investors a broad selection of companies and research platforms – each with their own selling points.

DISCLOSURE: The writer holds shares in MindMed Inc and Cybin Inc.