- The psychedelic drug industry continues to rapidly evolve and expand

- Psychedelic stock prices have pulled back dramatically from recent highs

- The current red-hot sale in psychedelic stocks should not be expected to last

Human psychology is a funny thing.

When retail stores have a “sale”, it’s a sign that merchandise isn’t moving as fast as desired. The store discounts its stock in order to turn over inventory faster.

But shoppers ignore the underlying reason for the sale. They regard the discount (naturally) as a positive factor for themselves – and they reach for their wallet or purse.

Yet in markets, when a company’s share price falls and the stock is now available at a discount, investors often shy away. Seemingly, they would rather pay more than less.

Of course, there can be good reasons for avoiding a particular stock, or even a particular sector – despite the “discount”. If there have been adverse developments for the company or sector, then stock may be cheaper for a reason. Much like how retailers discount damaged merchandise.

Big sale on psychedelic stocks

Psychedelic drug stocks are now heavily discounted from recent highs. Is this “damaged merchandise” or a bona fide sale?

Psychedelic Stock Watch is a close observer of both the psychedelics industry and individual companies. Here are just some of the larger positive developments we’ve seen in recent weeks:

a) Vast sums of capital flowing into the sector.

b) Several U.S. states moving toward psychedelics legalization, Oregon has legalized psilocybin for medicinal use, California has proposed legalizing possession of several psychedelics.

c) The first psychedelic drug stock ETF was created, providing increased exposure and demand for these stocks.

d) First commercial export of psilocybin.

e) Brazilian market opened up for recreational sales of psilocybin.

f) Health Canada rapidly broadening medical exemptions for (legal) psilocybin usage.

Individually, these companies have been active with a plethora of initiatives: new IP, M&A, patent applications, expanding medical clinic operations, product launches, new clinical and pre-clinical studies, etc., etc.

Meanwhile the scope of this sector continues to get larger. The primary focus of the psychedelic drug industry has been on its extremely promising potential to address the Mental Health Crisis – which currently afflicts roughly 1 out of 6 people on the planet.

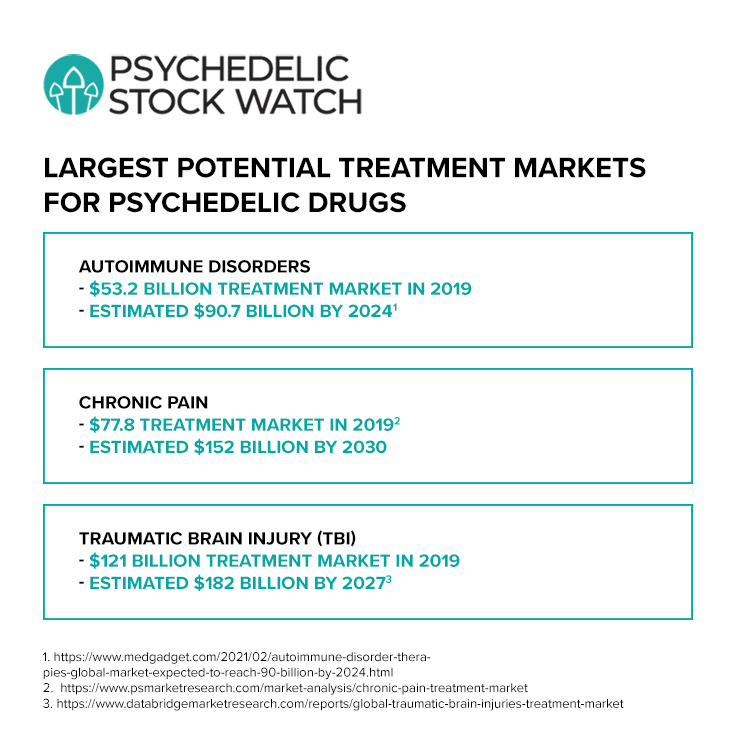

However, as Psychedelic Stock Watch has recently observed, new treatment markets being targeted by psychedelic drug research represent even larger individual markets than the various mental health treatment markets.

In short, psychedelic stocks are definitely not “damaged goods”. Individually and collectively, they are more attractive now (at their discounted prices) than when they were at their previous highs.

NASDAQ selloff drags down psychedelic stocks

Is there any other reason why investors may be shying away from these stocks at the moment? Yes.

We’ve seen a significant selloff in U.S. markets – especially the tech stocks of the NASDAQ. The biotech stocks of the psychedelic drug industry have been caught in this wake and dragged down.

NASDAQ stocks were (and are) grossly overvalued. Anyone not wearing a set of rose-colored glasses is aware of that fact.

Will this tech selloff be allowed to continue? The Federal Reserve has provided 9 trillion reasons to answer “no”.

The Fed has already pumped roughly $9 trillion into the U.S. financial system over the past 18 months, much of it with the explicit goal of inflating stock prices. That exceeds (in dollar value) all previous market “operations” by the Fed combined throughout its entire history 108-year history.

In sophisticated circles, the Federal Reserve is now regarded as a joke: a never-ending money pump to bail out the bad bets of Wall Street – and help the Fat to get fatter.

Allowing the NASDAQ selloff to continue would mean wasting much/all of its recent efforts, and it would violate every market-pumping instinct of these central bank sycophants.

In short, psychedelic drug stocks are a bona fide sale. Now that we have that settled, here are five (of the many) red-hot bargains for investors.

The two industry leaders. The two cheapest companies among psychedelic stocks in terms of cash-to-market-cap. And the leading public company addressing the recreational market for psychedelics.

Compass Pathways (US:CMPS) on sale

- NASDAQ listing

- Raised over US$250 million to date

- Phase 2 clinical trial for treatment-resistant depression (fast-tracked by the FDA)

- Part of the atai psychedelics research platform

- High-profile investors

MindMed Inc (CAD:MMED / US:MMEDF) on sale

- Raised nearly US$200 million to date

- Three Phase 2 clinical trials underway

- Numerous Phase 1 and pre-clinical initiatives

- Application for NASDAQ listing

- High-profile investors

Cybin Inc (CAN:CYBN / US:CLXPF) on sale

- Raised CAD$84 million since going public on November 10, 2020

- Phase 2 clinical trial for Major Depressive Disorder

- Expanded R&D capacity with acquisition of Adelia Therapeutics

- Market cap of only CAD$207 million

Mind Cure Health (CAN:MCUR / US:MCURF)

- Raised CAD$29.6 million since going public on September 21, 2020

- Recently launched nootropics product line

- Opening first psychedelics-assisted clinic (May 2021)

- Strategic investment in Alberta-based psychedelics clinic

- Market cap of only CAD$45 million

Red Light Holland (CAN:TRIP / US:TRUFF) on sale

- Leading public company targeting recreational markets for psychedelics

- Recently closed CAD$11.6 million bought deal financing

- Received authorization to begin psilocybin imports into Brazil

- Active in Netherlands market for psilocybin truffles

A sector on sale

These are just some of the red-hot sales in psychedelic drug stocks at present. All public players in the industry are well off their recent all-time highs.

What is holding back investors?

It’s not the drug R&D. Research results have been spectacular. Clinical trials continue to advance. And psychedelics R&D is rapidly broadening into other fields of medical research.

It’s not a failure to take advantage of opportunities in mental health treatment markets. While MINDCURE prepares to open its first clinic, Field Trip Health (CAN:FTRP / US:FTRPF) and Novamind Inc (CAN:NM / US:NVMDF) are already generating significant revenues in the U.S. from ketamine-assisted psychotherapy. In Canada, Numinus Wellness (CAN:NUMI / US:LKYSF) has clinic operations in both Vancouver and Montreal.

It’s not a lack of capital. Roughly US$700 million has been raised by the industry just since the Compass Pathways IPO last September. Over US$400 million of that has been raised by pubcos.

It’s not a lack of interest. The media is very interested in psychedelics and providing much friendlier reporting than with the cannabis industry. Wall Street and Silicon Valley are both interested in this industry. And the world’s largest individual donor for psychedelic drug research is (believe it or not) the U.S. Department of Defense.

Investors may still have fears concerning the regulatory reforms needed to normalize these drugs. But as already noted, recent developments in this facet of the industry have been extremely encouraging.

In fact, the only thing missing from the psychedelic drug sector at present is stronger sentiment among retail investors. But this is still a sector in its infancy. As a reminder, even one year ago, none of these companies had commenced public trading.

Now, these companies are currently (and irrationally) discounted. But don’t expect the sale on psychedelics stocks to last.

Looming on the horizon is the atai Life Sciences IPO. Atai just raised another US$157 million and will immediately become the new industry leader when it commences trading.

The atai IPO is even more eagerly anticipated than when Compass Pathways began trading. And that IPO catapulted the entire sector. That’s just one of several potential sector-wide catalysts.

Save money on psychedelic drug stocks today – while the sale lasts.

DISCLOSURE: The writer holds shares in MindMed Inc, Cybin Inc, Numinus Wellness, Novamind Inc and Mind Cure Health. Mind Cure Health is a client of Psychedelic Stock Watch.