In an industry of strong value propositions, we identify the most cash-rich companies.

In markets that are increasingly dominated by investors chasing momentum, value investing has been largely forgotten.

However, with markets wobbling in recent weeks and even some of the Big Banks warning of an “imminent correction”, some of these momentum-inflated stocks may suddenly look significantly less appetizing.

The best value proposition in life sciences

For value investors, psychedelic stocks offer a powerful value proposition. The Big Picture illustrates almost infinite potential.

A global Mental Health Crisis has resulted in two billion treatable mental health disorders, leading to 8 million preventable deaths per year.

Public companies in the psychedelic drug industry are currently targeting treatment markets with a combined value of $330 billion. Yet these public companies currently sit with collective market caps of well under $10 billion.

Most importantly, psychedelic medicine is revolutionary.

These new mental health therapies don’t merely represent incremental improvements on the mediocre standard of care in mental health. Rather, where conventional therapies (and pharmaceuticals) provide only crutches, psychedelic drug-based therapies are delivering cures.

A healthcare revolution. And this revolution may very well extend into many other major treatment markets beyond mental health: pain management, neurological and other autoimmune disorders, and even weight management.

Psychedelic drugs possess unique medicinal properties to “reset” or “rewire” the human brain. Research at the preclinical level is even showing that psychedelic drugs can generate new neural connections.

Many next-generation psychedelics-based therapies are already reaching advanced clinical trials. Considerable progress has been announced to date in 2021 in terms of clinical trial results and/or the initiation of new clinical trials and studies.

On the treatment front, between organic growth and new clinic acquisitions, psychedelic drug companies are rapidly expanding the footprint of this industry in mental health.

While the industry has moved steadily forward, market caps have shrunk this year – as psychedelic stocks have been pulled lower by persistent selloffs in tech stocks.

This may give some investors pause for concern, especially with the broader markets looking shaky. However, psychedelic drug companies are extremely well financed for such a new industry.

Balance sheet strength for psychedelic stocks

Public companies in this space have already raised in excess of $1 billion. That’s not bad for an emerging industry where the first public companies only began trading roughly 18 months ago.

As noted, combined market caps for these public companies sit well below $10 billion. That is a very solid capitalization ratio for an emerging industry with such enormous growth potential.

With institutional investors lining up to throw money at these public companies, the industry cashed up – especially toward the latter half of 2020 and early 2021.

The result is companies that are (on average) capitalized for several years of operational growth at their present burn rate. Significant growth potential without the need for any dilution of shareholder equity.

That’s an important insurance policy for investors as stocks face a more-challenging climate, at least over the short term.

Beyond the capital being raised, the industry is already starting to generate revenue streams. While most psychedelic drugs remain mired in War on Drugs prohibition, one psychedelic drug – ketamine – is already fully legal.

Ketamine-based therapies are also showing the potential for significant improvements in the existing standard of care for depression as well as addiction and PTSD. Huge, underserved treatment markets are already being penetrated by next-generation ketamine-based therapies.

The combination of strong balance sheets and compressed valuations is a sector with a lot of compelling bargains for value-focused investors.

Extremely cheap valuations

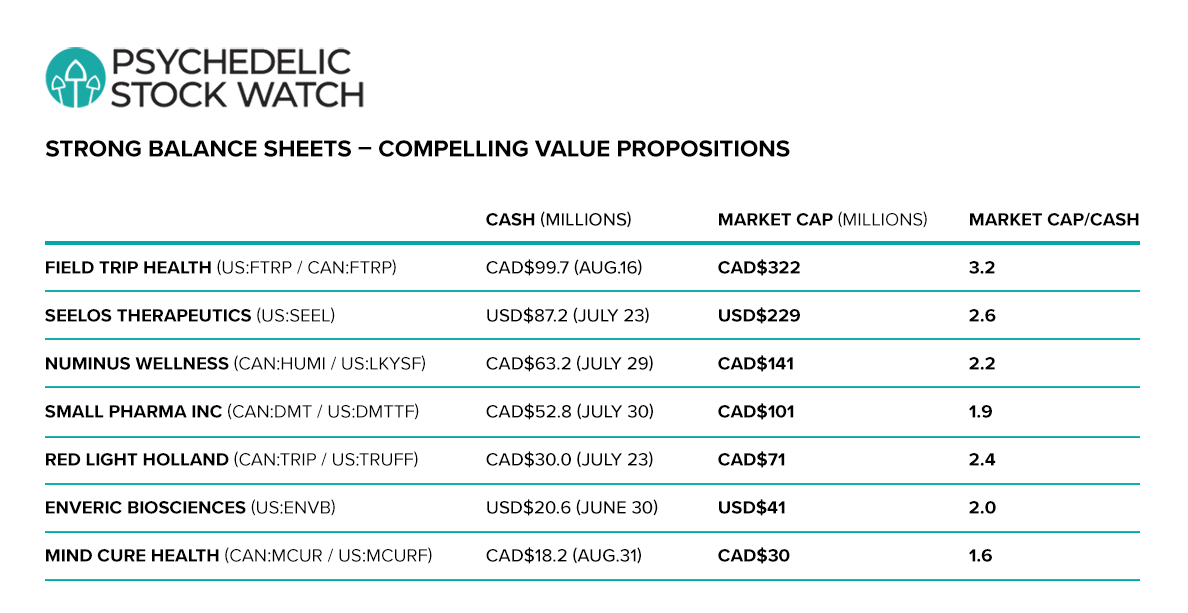

Overall, psychedelic drug stocks sit with a current cash-to-market-cap ratio of ~6:1. However, within this whole sector of cheap stocks, some of these companies stand out as especially bargain-priced.

Often, the smaller companies in an emerging industry are seen as weak sisters, in part because they lack the financial strength to execute on operational priorities.

Not so with psychedelic stocks. Balance sheet strength extends from industry leaders like atai Life Sciences (US:ATAI), Compass Pathways (US:CMPS) and MindMed Inc (US:MNMD / CAN:MMED) each sitting with $100s of millions in cash, all the way down to microcaps like Mind Cure Health (CAN:MCUR / US:MCURF).

Cash-rich companies, in a high-growth industry. Providing mental health solutions, at a time of the worst mental health pandemic in history.

Given this context, many people will look at psychedelic stocks as representing a very secure investment proposition.

In contrast, in times of market instability investors have typically looked to blue-chip stocks for security. However, today, most of these blue-chip stocks sit with bubble valuations.

U.S. corporate debt, in general, has soared to record levels – now topping $11 trillion.

These blue-chip stocks purchased their inflated valuations via low interest rates, as they recklessly piled on debt to buy back their own shares. In a previous (more responsible) era, the recent “financial strategies” of these blue-chip(?) corporations would have been labeled Ponzi schemes.

Now, with these stocks extremely overvalued, the Federal Reserve is showing a clear bias toward higher interest rates. Look out below! Today, blue chip does not equal security.

Cash-rich psychedelic stocks aren’t vulnerable to fluctuations in interest rates. And they have the balance sheet strength to weather adverse market conditions.

Consequently, where many blue-chip stocks are poised for potential meltdowns, psychedelic stocks are instead positioned for spectacular growth.

Melting up, not melting down

Emerging psychedelic drug companies are pursuing treatment markets valued at $330 billion with advanced-stage clinical research, while sitting (collectively) with a market cap well below $10 billion.

These cash-rich companies are developing revolutionary drug IP and rapidly expanding treatment capacity for a global population of two billion mental health disorders – currently lacking adequate treatment options.

At a time when public companies in the broader markets sit with the most-inflated valuations and the highest debt-levels on record, psychedelic stocks sit with no debt and extremely compressed valuations.

For psychedelic stocks, the only direction over the longer term is up. For blue-chip stocks, the only direction over the longer term is down.

It’s not hard to identify the superior investment proposition here.

DISCLOSURE: The writer holds shares in MindMed Inc and Mind Cure Health.