Earlier this week, Psychedelic Stock Watch published an update on overall progress in the psychedelic drug industry.

We touched on everything from drug development to drug legalization. Included in that analysis was a detailed look at recent financings in the psychedelic drug industry.

A regular theme in our coverage of the psychedelics industry can be summed up in three words.

Follow the money.

Why does Psychedelic Stock Watch continue to shine its magnifying glass on that aspect of the sector?

a) This is a capital-intensive industry

b) Tracking financings in an emerging industry is an excellent gauge of growth for both individual companies and the overall sector

b) Tracking financings in an emerging industry is an excellent gauge of growth for both individual companies and the overall sector

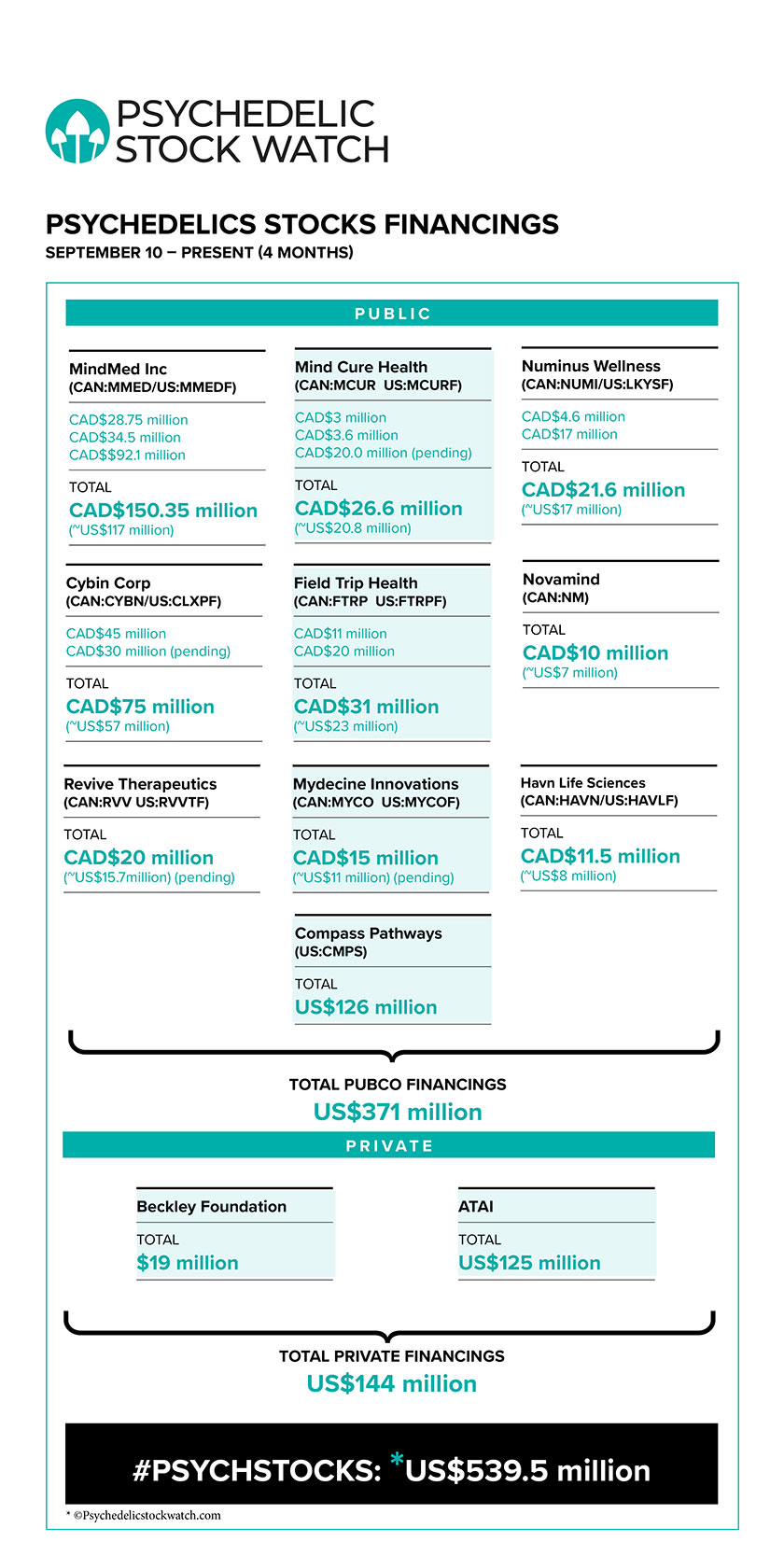

With these two factors in mind, we have compiled financial data on recent public offerings for the leading players among both public companies and private corporations/institutions.

Big dollars chasing a big opportunity

We went back roughly 4 months, from the time of the Compass Pathways IPO to the present. That IPO really ignited the sector in the middle of September – and financial activity since then clearly illustrates this.

Over US$500 in raised in ~4 months. Of that total, US$371 million was raised by public companies.

Those sorts of capital flows into small-cap stocks would be impressive for even a mature industry.

None of these companies even existed as pubcos a year ago. To see capital flows like this into an emerging industry in (literally) its first year of existence is virtually unheard of.

But the massive quantities of dollars are only half the story. Perhaps even more illuminating is to track the progress of these financings for individual companies.

Compass Pathways (US:CMPS)

Compass Pathways immediately got the attention of the market with its IPO financing. A $120 million offering was upsized to $146.6 million. And then the company’s stock price quickly doubled in early trading.

While Compass itself has been somewhat quiet since that time, its big IPO financing greased the wheels for the whole industry in raising capital.

Over this period of time, two public companies have each announced three new financings.

MindMed Inc (CAN:MMED / US:MMEDF / GER:MMQ)

On October 30, 2020, MindMed closed on an oversubscribed private placement of CAD $28.75 million. Units were priced at CAD$1.05.

On December 11, 2020, MindMed closed on an oversubscribed private placement of CAD$34.75 million. Units were priced at CAD$1.90.

On January 7, 2021, MindMed closed on an oversubscribed private placement of CAD$92.1 million. Units were priced at CAD$4.40.

In a span of less than 2 ½ months, MindMed:

- Raised CAD$155.6 million (US$121.4 million)

- The size of the financings increased by 220%

- The price of the financings increased by 319%

Given that this is a capital-intensive industry, what’s the message these financings send to the market?

MindMed has a proven capacity to raise lots of capital. Successive financings have been at much higher price levels.

For institutional and high net-worth investors, this tells them that they can invest in MindMed without fear of going underwater on their investments.

Going back even further, MMED’s May 2020 financing was at a unit price of CAD$0.53. Part of the reason for the extremely strong financing in December was a track record of rewarding participants in previous placements through strong price appreciation.

Mind Cure Health (CAN:MCUR / US:MCURF)

The other public company to have closed on three new financings in roughly the last four months is Mind Cure Health. The company launched its own IPO one trading day after Compass Pathways, on September 21, 2020.

On September 17, 2020, MCUR announced closing an oversubscribed placement for its IPO of CAD$3.0 million. Units were priced at CAD$0.20.

On November 19, 2020, Mind Cure announced closing an oversubscribed private placement of CAD$3.6 million. Units were priced at CAD$0.45.

On January 22, 2020, Mind Cure announced its recent bought deal financing has been doubled to CAD$20 million. Units are priced at CAD$0.60.

In the span of just over 4 months, Mind Cure:

- Raised CAD$26.6 million (US$20.7 million)

- The size of the financings increased by 567%

- The price of its financings increased by 200%

Obviously Mind Cure can’t compete with MindMed – an industry leader – in terms of the quantities of capital being raised. But apart from that, we see a very similar pattern.

Financings are increasing rapidly in size. Investors are being rewarded for their participation through strong increases in unit prices.

Apart from MindMed and Mind Cure, three other public companies in the psychedelics space have announced two financings.

Numinus Wellness (CAN:NUMI / US:LKYSF)

Numinus is another pubco whose recent financings also present a very bullish profile for investors.

On September 10, 2020, Numinus closed on an oversubscribed private placement of CAD$4.6 million. Units were priced at CAD$0.25 with the stock trading slightly below that price on the day the financing was announced.

That bullish signal to investors (along with CMPS IPO) ignited the stock. At its 2020 high (CAD$2.46), it was a ten-bagger from that price level.

On December 29, 2020, Numinus announced the closing of an oversubscribed CAD$17 million bought deal offering. Units were priced at CAD$0.90.

More than three times as much cash raised. Unit price was also over three times higher. The pattern continued.

Field Trip Health (CAN:FTRP / US:FTRP)

Field Trip has also closed on two successful financings. On October 6, 2020, Field Trip Health commenced public trading. The company closed on a CAD$11 million financing for its IPO transaction. Units were priced at CAD $2.00.

On January 5, 2021, Field Trip closed on an oversubscribed bought deal offering of CAD$20 million. Units were priced at CAD$4.50.

Another psychedelic drug company demonstrating the capacity to successfully raise capital. Investors again rewarded for their participation.

Cybin Inc. (CAN:CYBN)

Cybin somewhat breaks the pattern when it comes to financings for psychedelic stocks.

CYBN commenced public trading in Canada on November 10, 2020 via reverse take-over. As its qualifying transaction, Cybin closed on a massive (oversubscribed) CAD$45 million placement, with units priced at CAD$0.75.

At the time, it was the largest Canadian financing in the entire psychedelics sector. On January 19, 2021, Cybin's recently announced bought deal financing was upsized to CAD$30 million. Units are priced at CAD$2.25.

Even if the full over-allotment is exercised, the financing will still only total CAD$34.5 million.

A psychedelics company doing a smaller financing?

Clearly, we would need to attach an asterisk to this new offering. After CYBN closed on (at the time) the largest Canadian psychedelics financing, that was a high bar to meet for its next deal.

Also, it’s not necessarily a matter of Cybin not wanting to raise more capital, but rather Cybin not needing to raise more capital.

Even with a unit price that is triple its initial financing price, this placement still increases the share structure. With psychedelics financings closing at rapidly increasing prices, why raise more capital than needed today?

As noted in the graphic above, Novamind Inc (CAN:NM) (CAD$10 million), Revive Therapeutics (CAN:RVV) (CAD$20 million), Mydecine Innovations Group (CAN:MYCO) (CAD$15 million), and Havn Life Sciences (CAN:HAVN) (CAD$11.5 million) have either announced or closed on robust bought deal offerings of their own.

Altogether, it amounts to a very impressive US$371 million in little more than four months. Throw in the private financings and the sector has raised over half a billion dollars in this span.

Making money in psychedelic stocks

Lots of capital being raised in a series of successful financings. Dollar values and unit prices are steadily increasing. All of these offerings are oversubscribed.

But that’s not the most important takeaway for investors. Investors (by definition) invest to make money.

How do you make money in psychedelic stocks? The pattern is obvious.

Invest in a private placement for one of the leading psychedelic drug companies and history shows you will do very well.

What if you’re not an institution or accredited investor and can’t participate in one of these offerings?

Follow the money. Investors who have bought in after these deals have been announced also prospered in 2020.

Buying shares on the market isn’t quite as sweet a deal. For one thing, you don’t get the additional inducement of a half-warrant with each unit purchased.

But once a deal has been announced, the company is cashed up to execute on their business model. Buying into quality companies right after they have capitalized is a tried-and-true formula for successful investing in small-cap stocks.

These public companies aren’t raising all this capital merely to strut around and boast about large cash balances. They are using this capital to advance operations: drug R&D, mental health clinics, digital platforms to advance mental health care, and M&A.

That was the message from the previous Psychedelic Stock Watch article.

Psychedelic stocks offer strong risk/reward profile

Investing in an emerging sector is always exciting and usually high-risk. However, investors in psychedelic stocks are being presented with a very favorable risk/reward profile.

Numerous multi-billion-dollar mental health treatment markets currently suffer from a woefully inadequate standard of care. Over 1 billion people are afflicted by what is now known as the Mental Health Crisis.

Clinical studies on psychedelic drugs (and psychedelics-assisted therapies) are showing the clear potential to revolutionize mental health care in these treatment markets.

Psychedelic drug companies are raising capital in big gobs to finance this Revolution.

Given this extremely positive investment outlook, to the surprise of no one, high-profile investors from Silicon Valley, Wall Street and elsewhere are piling into the space.

Investors are growing increasingly nervous regarding the bubble prices of many of the most popular companies in the broader markets. Psychedelic stocks represent something different: strong returns in an emerging sector, with almost limitless long-term growth potential.

Not chasing momentum in over-priced stocks. Old-fashioned investing.

DISCLOSURE: The writer holds shares in MindMed Inc, Numinus Wellness, Cybin Inc and Mind Cure Health. Mind Cure Health is a client of Psychedelic Stock Watch.