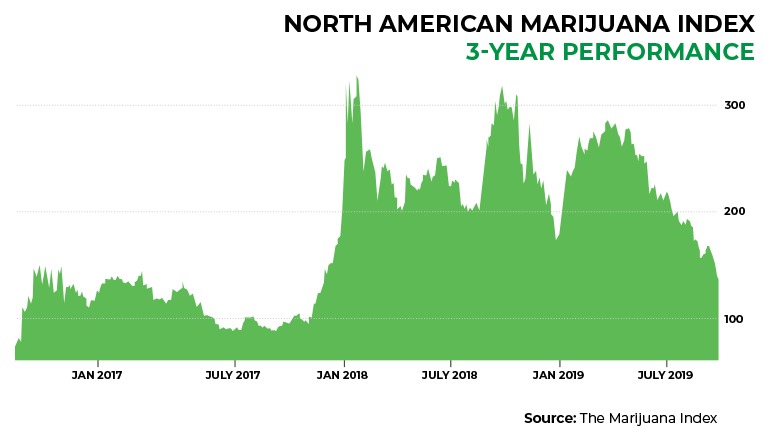

How cheap? Look at the chart.

The cannabis industry has been steadily growing and developing (and the sector itself is still in its infancy). But valuations across the cannabis space are essentially at a two-year low.

It’s a massive disconnect. Now several former investment bankers with the Big Banks are looking to capitalize on it.

Cannabis investors who have endured the long-and-irrational trough in cannabis stocks may look at this as opportunistic buying. However, the reality is that the $2 billion that these (former) JPMorgan (US:JPM) and Deutsche Bank (US:DBK) plan on injecting into the cannabis industry should be a welcome shot-in-the-arm for valuations.

Such news may also cause the short-sellers targeting cannabis stocks to take their profits (from the last 6 months) and run. As noted in a recent Seed Investor article, short positions in the cannabis sector are excessive by any measure.

Valuations are at a two-year low. Any substantial catalyst for a new rally in the sector could quickly morph into a painful short-squeeze.

As reported by Bloomberg (and covered by The Seed Investor), the new vehicle for these cannabis-related activities is Silver Spike Capital. The overall $2 billion that is planned for deployment is to be spread across direct lending and public and private equity investing.

Silver Spike plans to focus on direct lending, expecting to have $500 to $1 billion in place by Q4. Thanks to current, low valuations in the sector, Silver Spike’s CEO, Scott Gordon sees this as an especially lucrative opportunity.

“You can structure really interesting loans to very viable borrowers at juicy returns,” he said.

In other words, cannabis stocks are so over-sold that cannabis companies would rather borrow directly (even at relatively high rates) versus raising capital through selling their grossly under-valued stock. Investors (and short-sellers) take note.

What happens when cannabis stocks reverse higher? Investors who have been in this space for a few years can answer that question.

Cannabis stocks can move from floor to ceiling with lightning speed. The Index for North American cannabis stocks more than tripled in 2 ½ months at the end of 2017.

There is one very important difference between the peak of that rally (on January 8, 2018) and the current, brutal trough in marijuana stocks.

The valuations seen at that peak were simply premature. Cannabis will be a trillion-dollar global industry over the long term – once governments get out of the way and allow full commercialization of this Miracle Plant.

The current trough in valuations is totally irrational. Cannabis revenues in the Canadian cannabis industry have been soaring since April at a double-digit rate. Valuations have been moving in the opposite direction.

In the United States, cannabis stocks are even more heavily discounted to regulatory uncertainty and inefficiency. Yet in 2019 alone, over 1,100 state and federal bills have been tabled for cannabis reform.

The SAFE banking bill has now been passed in the House of Representatives. The FDA has promised to roll out a new regulatory framework for CBD commerce this year. Congress has been holding direct hearings for the national legalization of cannabis. And the list goes on and on.

We are seeing a total disconnect between what these cannabis companies are worth and the market caps of these companies, generated by their rock-bottom share prices.

What is the one thing worse than being a cannabis investor, who has had to endure this long, brutal and totally unjustified plunge? Being heavily positioned on the short side of the cannabis industry when the stocks go on a run.