Back in the real world, the cannabis industry is demonstrating growth potential that would be the envy of most other industries. As we have done consistently, The Seed Investor points to Colorado.

Colorado has the world’s most-mature fully legal cannabis market. It has (already) made the most progress in phasing out the cannabis black market in that state.

It has achieved this by doing a better job in regulating its legal cannabis industry. More specifically, it has resisted the temptation of most states (and most Canadian provinces) to over-regulate its legal cannabis industry.

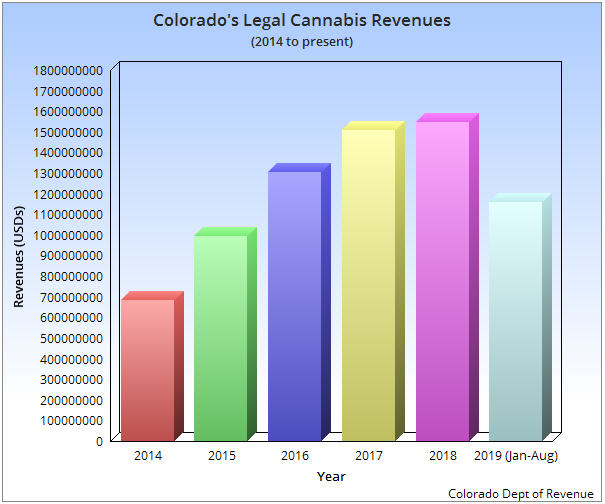

Beyond this, the numbers speak for themselves. The Seed Investor has just reported that Colorado has set another monthly record in sales revenues for its legal cannabis industry.

- August’s sales record was the 3rd consecutive monthly record, and 4th in the last 5 months

- The new record represented a 4% gain in month-over-month sales

- At the August rate of cannabis sales, Colorado’s legal cannabis sector is now a $2 billion per year industry

Given the trend in sales, $2 billion in legal cannabis revenues over the next 12 months looks very conservative. This is remarkable.

It wasn’t until 2016 that Colorado’s annual cannabis revenues first exceeded $1 billion. Revenues can be expected to top $2 billion in 2020, barring a sharp reversal of the current trend.

In more general terms, what this says to the legal cannabis industry (and cannabis investors) is that this is a sector that has no ceiling in terms of consumer sales, over any short- or medium-term horizon. Contrast this with a projection for Colorado’s legal cannabis industry from business information leader, Statista.

In an estimate for 2016 – 2025, Statista saw Colorado’s cannabis revenues going from $1.34 billion in 2016 to $1.94 billion by 2025 (much too low). In particular, Statista predicted that Colorado’s cannabis revenues would start leveling off by 2018 and reach a plateau.

Ironically, Colorado’s cannabis revenues did level off in 2018, rising only from $1.51 billion to $1.55 billion. It’s the only year since Colorado fully legalized cannabis in 2014 that annual revenues haven’t risen by at least 15%.

In 2019, legal sales are once again on pace to show 15+% annual growth.

Six years into full cannabis legalization, cannabis sales in Colorado are currently accelerating. That is what a well-regulated cannabis industry looks like.

As The Seed Investor has pointed out in a previous article, if cannabis was already full legal across the U.S. (and properly regulated like in Colorado), this would be a $108 billion industry in the United States today.

In Canada, the province of Alberta appears to be following in the footsteps of Colorado. The province is Canada’s clear (per capita) sales leader, and it has already opened up over 270 cannabis retail locations in less than one year of full legalization.

Despite the delays in several Canadian provinces to open retail cannabis stores for consumers, Canada’s cannabis industry is also demonstrating strong sales growth, with a double-digit increase in sales reported again for the month of July.

Overall, Canada’s legal cannabis industry is on track to more than triple in size in the first full year of legalization. Myopic and backward-looking ‘analysis’ from the mainstream media on cannabis companies and the cannabis sector simply ignores these fundamentals.

This sets up the sector for a sharp reversal (higher) in marijuana stock valuations as increasing revenues collide with falling share prices. We’ve seen no reversal yet.

However, experienced investors know that markets can remain “irrational” for extended periods. This is particularly true when investors have difficulty in finding reliable information on particular companies, or a particular sector.

Reliable information on cannabis and the cannabis industry is in short supply. This disconnect between valuations and sector fundamentals represents an enormous opportunity for contrarian investors.

Big Media continues to obsess about the less than 0.002% of U.S. cannabis consumers who have experienced health issues from poorly regulated vapes in the United States. But it virtually ignores the 0.13% of Americans who die from tobacco use every year.

For investors who tire of this Trivial Pursuit, spend more time looking at the facts from Colorado’s dynamic cannabis industry. And spend less time on the vacuous, anti-cannabis Fake News from the mainstream media.