Earlier today in a TSI Exclusive, we shone the spotlight on cannabis extraction specialists. TSI noted that at present, the best opportunities appeared to lie with some of the large-scale extraction specialists based in Canada.

Why extraction?

The cannabis industry is currently hampered (primarily) by two obstacles: over-regulation and bureaucratic inefficiency. This is both delaying the commercialization of cannabis and adding to the costs of doing business.

This eats into margins at both the wholesale (cultivation) and retail ends of the industry. Largely immune to these issues are intermediate segments of the industry like cannabis extraction. Charts for companies like MediPharm Labs and Valens GroWorks illustrate this potential.

Those aren’t the only segments of the cannabis industry at least partially sheltered from the issues previously mentioned. Manufacturers/suppliers of high-margin cannabis accessories are also positioned to enjoy maximum upside with minimum headaches.

Only last week, TSI pointed to another emerging trend in the cannabis industry. The Canadian cannabis industry is looking south for suppliers of vaporizers, vape pens, and related accessories.

Canada is preparing for Phase 2 of its national cannabis legalization. This includes introducing cannabis edibles and other infused products, as well as vape pens, vaporizers, and other accessories.

Canadian companies need to stock up. Here U.S.-based companies have the advantage. With markets for such products having been legalized earlier, U.S. companies boast the brands, the expertise, and the scale to move in.

This leads back to IONIC Brands Corp. (CAN: IONC, US: ZRRRF, FRA: IB3).

IONIC is a vertically-integrated multi-state operator (MSO). Its strong brands portfolio is spread across several U.S. states, including California, Washington State, and (now) Nevada. But in particular, the Company is heavy in vaporizer brands.

(IONIC’s line of premium vaporizers, #1 in Washington State)

Then there is today’s announcement: closing on the acquisition of Vegas Valley Growers (VVG).

IONIC’s acquisition of Vegas Valley Growers, based in Nevada, adds to the Company’s vertically-integrated, multi-state assets. Exciting news.

Nevada is projected as a huge cannabis market in 2019 (US$400 million). In just the first half of 2018, Nevada logged more cannabis revenues (US$195 million) than Washington State (US$67 million) and Colorado (US$114 million) combined.

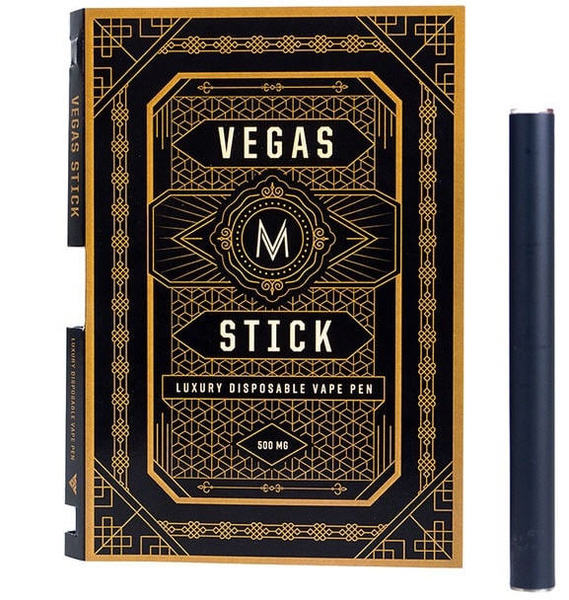

Headlining VVG’s product line is the “Vegas M Stick”. An established Nevada vape pen brand, estimated 2019 U.S. revenues for this one product alone are $6.6 million. This also sets up IONIC to look north.

Today’s announcement is a two-for-one for investors.

IONIC Brands has established a significant presence in one of the U.S.’s most dynamic cannabis markets, Nevada, and added to its brands portfolio. Much like it did in California with its April 2019 deal with Origin House.

IONIC is also now a more attractive partner for Canadian-based cannabis companies looking to the U.S. for established and successful vaporizers/vape pens.

DISCLOSURE: IONIC Brands is a paid client of The Seed Investor.

IONIC Brands has established a significant presence in one of the U.S.’s most dynamic cannabis markets, Nevada, and added to its brands portfolio. Much like it did in California with its April 2019 deal with Origin House.

IONIC is also now a more attractive partner for Canadian-based cannabis companies looking to the U.S. for established and successful vaporizers/vape pens.

DISCLOSURE: IONIC Brands is a paid client of The Seed Investor.