TSI Investor Profile: ABcann

Featured Video

Company Brief

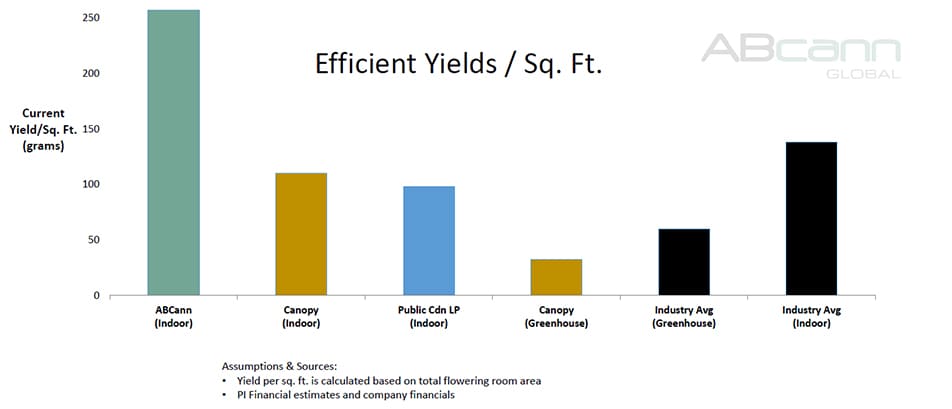

Licensed since March 2014, ABcann sets itself apart from other Canadian licensed producers with its 94% customer retention rate, its focus on organic cultivation in proprietary growing chambers and its industry-leading production yields in excess of 250 grams per sq. ft., double the industry average.

The company, which is in the process of developing its 65-acre site with a second 150K sq. ft. facility, has a research partnership with the University of Guelph and and has supplied innovative cannabis inhaler device maker Syqe Medical with its standardized cannabis.

Summary

Fiscal Year-End: December

License Renewal Month: October 2017

Licenses: 1

Licensed Capacity: 625 kilograms

Number of Patients: N/A

Headquarters: Napanee, Ontario

Financials (pro forma 09/30)

Cash on hand: $28.9mm

Fixed Investment: $5.72mm

Shareholders’ Equity: $17.8mm

Revenues – Last Quarter: N/A

Adj. Gross Margin: N/A

EPS: N/A

Capital Structure (04/23/17)

Last Financing: 12.875mm shares at $0.80

Basic Shares: 97.20mm

Warrants: 39.71mm

Options: 9.41mm

Diluted Shares: 173.83mm

Highlights

- Focus on pharmaceutical grade plant standardization

- 94.7% customer retention rate

- Organic production using exclusive, computer-controlled environmental system

Growth Strategy

- Expand existing facility and construct 2nd facility targeting 40 kg/annum production capacity

- Pursue global initiatives in Europe, Israel and Australia

- Active discussions to license production to U.S. operators

Differentiators

- Production through computer-controlled environmental systems

- Industry-leading efficiency in terms of yield per square foot

- Research partnership with University of Guelph

Above Industry Average Yields

ABcann’s standardized organic growing methods yield not only a higher quality product as reflected by its premium pricing but also a lower overall cost. According to PI Financial, ABcann is able to produce almost double the industry average as measured by grams per square foot.

Strong Advisory Board Led by

the “Father of Cannabis Medicine”

Dr. Raphael Mechoulam is an Israeli organic chemist and professor of Medicinal Chemistry at the Hebrew University of Jerusalem in Israel. Mechoulam is best known for his work (together with Y. Gaoni) in the isolation, structure elucidation and total synthesis of Δ9-tetrahydrocannabinol, the main active principle of cannabis and for the isolation and the identification of the endogenous cannabinoids anandamide from the brain and 2-arachidonoyl glycerol (2-AG) from peripheral organs together with his students, postdocs and collaborators.

Dr. Raphael Mechoulam is an Israeli organic chemist and professor of Medicinal Chemistry at the Hebrew University of Jerusalem in Israel. Mechoulam is best known for his work (together with Y. Gaoni) in the isolation, structure elucidation and total synthesis of Δ9-tetrahydrocannabinol, the main active principle of cannabis and for the isolation and the identification of the endogenous cannabinoids anandamide from the brain and 2-arachidonoyl glycerol (2-AG) from peripheral organs together with his students, postdocs and collaborators.

Related Articles

ABcann Global (TSX-V: ABCN ) Announces Inclusion on the Horizons Medical Marijuana Life Sciences ETF

ABcann Global Corporation (TSX-V: ABCN ) is pleased to announce its inclusion in the Horizons Medical Marijuana Life Sciences ETF (TSX: HMMJ ).

ABcann Global Recruits Dr. Michael Shannon as Chief Medical Consultant

ABcann Global Corporation (TSX-V: ABCN ) is pleased to announce that it has retained the services of Dr. Michael Shannon as its Chief Medical Consultant. Dr. Shannon served in the Canadian Armed Forces for 31 years, and also as Deputy Surgeon General for Canada.

Cannabis Wheaton (TSX.v: CBW) to invest $30 million in ABcann (TSX.v: ABCN) at huge Premium to Market.

Cannabis Wheaton ($CBW) reports that they have agreed to invest $30 Million with ABCann ($ABCN) to fund the construction of 50,000 square feet of cultivation space at ABcann's proposed cannabis cultivation facility to be located in Napanee, Ontario known as the Kimmett facility. Pursuant to the Agreement, Cannabis Wheaton will subscribe for $15 million of ABcann common shares at an agreed upon valuation of $2.25 per ABcann Share.