Thought to be impenetrable by others...

This tiny biotech unlocked

a treasure chest

of medical marijuana

secrets!

Thanks to this one piece of news,

projections for the medical marijuana

market can now be upgraded from

$7.3 billion to $120 billion!

Medical uses could now

be 10-times

bigger thanrecreational!

Big Pharma on alert!

Dozens of new

drugs on horizon!

This is just getting started!

Currently trading off-radar

around 28¢/share,

InMed Pharmaceutical (IMLFF)

could leap past

marijuana giant

GW Pharma (GWPH, $120 share)

in 2017 as the

world's leading

cannabis biotech.

This is a massive investment

opportunity that could

yield enormous gains

for seed-level investors!

You'll want to look into this now, before the news gets out!

InMed Pharmaceuticals (IMLFF) is already developing exclusive cannabis

treatments for glaucoma and a

rare childhood disease, Epidermolysis bullosa.

These alone hold an early $6.6 billion market potential and InMed has

more than 38 disease categories to target!

If you plan to invest in legalized marijuana markets you need to read this report now!

|

Special Report

|

InMed Pharmaceuticals (IMLFF) is set to dominate

the medical marijuana sector!

Nobody knew how big the medical marijuana story could become until InMed Pharmaceutical opened the vast storehouse of medicinal compounds locked in the cannabis plant.

Industry experts projected marijuana markets to leap over 400% by 2020. Now, those figures could be off ten-fold! [1]

Unbeknownst to most, the cannabis plant is brimming with trace compounds, many of which could revolutionize medicine.

85 of these compounds have already been identified...50 more are suspected.

InMed Pharmaceuticals may be the first and perhaps only company that can bring the full medicinal potential of all 135 cannabis compounds to market...

...and that makes its stock a staggering investment opportunity for those who get in front of this.

As an investor in emerging technologies...you'll want to be well in front of this development!

To the Aggressive Investor:

You're about to discover something quite extraordinary!

A completely off-radar biotechnology company, InMed Pharmaceuticals ($IMLFF), is set to revolutionize the medical side of legalized marijuana.

The profit opportunity here is simply staggering.

It starts with the explosive state of the marijuana market overall.

Fortune Magazine recently published its report on newly legalized marijuana putting the market at $21.6 billion by 2020... that's 322% market growth in just three years! [2]

Few things in history even approach what investors could be making in this explosive new marketplace. What's more, few people know what this market really holds.

Marijuana investing today is nothing like what it is about to become.

The notion of smoking your medicine is absurd!

Smoking a joint will never achieve the pharmacological standards necessary to for a physician to properly manage drug delivery and dosage. The only way to achieve that objective is to isolate the correct therapeutic compound in the cannabis plant, target it to a specific disease process, and deliver the medicine in controlled dosages, same as you would for any other prescription medicine. This is where InMed has made its stunning breakthrough.

Recreational marijuana is making the news, but the smart money is targeting the medicinal side for investing.

CB Insights reports that over $560 million in private equity funds has already been poured into 273 marijuana investments [3] ...and a large chunk of that went to the medicinal side.

In April 2016, Pennsylvania became the 24th state to legalize medical marijuana. Over 35 million Americans are now using medical marijuana. [4]

Projection:

Recreational marijuana markets will be highly fragmented consumer-driven markets unsuitable for prudent investing.

On the flip side, medicinal marijuana will concentrate in a few technology-driven biotechs. This is where the big gains will be made by today's marijuana investors.

If you've looked into the medicinal side, then you know that marijuana research and development has focused principally on therapeutic cannabidiol (CBD), which is now produced by extraction from the plant.

CBD holds potential as a highly effective compound for treating a number of disease processes.

Investors have already made fortunes off this infancy of medical marijuana.

Consider the short track record of GW Pharma, the current leader in the medical marijuana space. In just a few years time, GW Pharma stock rocketed from around $8/share to a high point over $130/share!

That's 1,625% growth over four years time...and GW Pharma only has a couple of cannabis compounds extracted for commercial exploitation!

There's so much more to the cannabis plant than that!

CBD is just a tiny fraction of the medicinal potential found in the cannabis plant! As you will learn in this report, InMed Pharmaceuticals could shatter GW's growth record! Here's why...

- InMed Pharmaceuticals (IMLFF) is currently an unknown, a true ground floor opportunity. Compare to GW Pharma, which was reasonably well established before investors began moving in.

- InMed Pharmaceuticals exploits the entire pharmaceutical potential of the cannabis plant. GW Pharma is limited to just a small percentage of that potential.

- InMed Pharmaceuticals holds patent-pending intellectual property which could generate hundreds of millions of dollars in revenue from each player in the cannabis pharmaceutical sector.

- InMed Pharmaceuticals is currently on track for developing new cannabis-based therapies to 40 distinct disease processes. The market potential in each of these can range from $1 billion to $6 billion or more...and InMed has already made substantial progress on the first two of those 40!

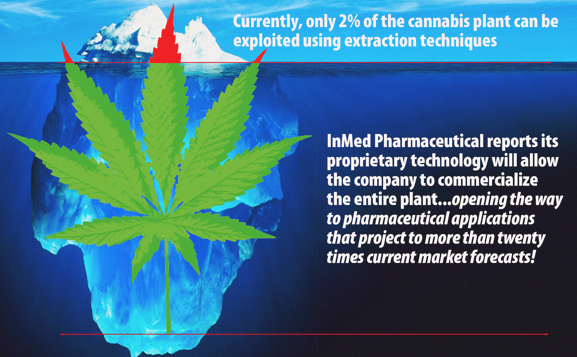

InMed Pharmaceutical's revolutionary technologies could shatter current limitations on medical marijuana...multiplying the market potential from current projections of $7.3 billion to over $120 billion!

The impact on InMed's market cap could be staggering. Within a short time frame, InMed could rocket from its current $26 million market cap to hundreds of millions of dollars...perhaps more than a billion!

Growth of this magnitude can yield breathtaking returns for those who step in with even modest initial investments.

The driving force behind InMed's growth potential will be its unique, proprietary capacity for monetizing the full potential of the cannabis plant!

When you come to realize the potential here, you'll quickly recognize that InMed Pharmaceutical could, in aggregate, be ultimately worth billions...and a lot of that could be realized virtually overnight in a big pharma buyout! (More about that in a moment!)

InMed Pharmaceutical is set to revolutionize the medical marijuana space.

Existing technology uses only about a half-dozen cannabis compounds that can be economically extracted from the cannabis plant.

These compounds are but a tiny fraction of its potential!

As many as 135 other unique trace cannabis compounds hold promise for countless new pharmaceutical uses...the pharmaceutical value locked in the cannabis plant is just now being realized... and stands totally unexploited!

Here's where medical marijuana is now....and here's where InMed Pharmaceuticals is taking it!

InMed Pharmaceutical may be the only biotechnology company in the world today capable of developing and commercializing these trace medicinal compounds!

The real potential in the cannabis plant is found much deeper

than what is easily extracted from the plant.

85+ known cannabinoids have already identified [5] and upwards to 50 more are suspected. Scientists worldwide have already concluded that each of these individual cannabinoids could be targeted to a specific therapy...creating an entirely new sector of pharmaceutical opportunities in medicine.

Research shows that herbal cannabis contains a far wider variety of therapeutic compounds, but only a handful of these can be extracted or artificially synthesized in commercial scale. The rest, despite having documented medical potential, have simply been ignored as being scientifically interesting, but commercially useless .

Currently, InMed Pharmaceuticals appears to be the only company that has the capability to commercialize the medicinal potential of these trace compounds. That could soon be worth billions as legal use of medical marijuana spreads nationwide.

Meet the team that is unleashing the full potential of the medical value hidden in the cannabis plant!

A group of original investors behind InMedjumped at the chance to finance the start-up of InMed Pharmaceutical. Two things put their money into play.

In 2015, they found one of their competitors (GW Pharma, the top of the cannabis biotech marketplace) top scientific minds – Dr. Ado Muhammed, who happens to be a leading scientist in the field of cannabinoid medicines. At GW, Dr. Muhammed was involved in the advanced delivery of core clinical research and was involved in key decision-making regarding R&D and GW's cannabis drug product commercialization.

The founders of InMed, then brought on former early-stage GW Pharma financier, investor, and Non-Executive Director, Peter Mountford.

They seized the opportunity, when finding Dr. Sazzad Hossain, Ph.D., M.Sc., he has more than twenty years of academic and industrial experience in new drug discovery and his leading accomplishment was inventing the technology that could fully exploit the medicinal potential of the marijuana plant.

The Founders and investment team knew Dr. Hossain's patents could be worth a fortune. They need only match them with expertise in pharmaceutical marijuana...and that match was made quickly.

It formed a perfect match. Dr. Hossain now serves as InMed Pharmaceutical's Chief Scientific Officer and Dr. Muhammed serves as Chief Medical Officer.

InMed went on to recruit Eric Adams as president and CEO. Mr. Adams is a seasoned biopharmaceutical executive with over 25 years' experience in company and capital formation, global market development, mergers & acquisitions, licensing and corporate governance. Mr. Adams is the force that will turn the science into cash!

These InMed Pharmaceutical executives report the company is now on track to methodically target and tap the full therapeutic potential of the cannabis plant.

Here's what InMed has that nobody else can touch (without writing a really big check)!

The Hidden Potential in Pharmaceutical Uses for Marijuana Will Change the World and Quite Possibly Make You Rich!

InMed Pharmaceuticals is about to take the cannabis biotech market to places no one...not even the experts...ever thought possible!

First and foremost, marijuana is going mainstream...within a few years, medicinal marijuana compounds will likely be legal throughout America. But medical marijuana demand will always be constrained by its haphazard delivery system...smoking and ingesting.

Until the trace cannabinoids within the marijuana plant can be produced in scalable quality and purity for pharmaceutical use...medical marijuana will remain a sidebar in serious medicine.

Serious medicine is what the team of Dr. Hossain and Dr. Muhammed is making possible!

Drs. Hossain and Muhammed are opening the way for a total disruption in the production and pharmaceutical use of cannabis compounds. You can expect markets for cannabis compounds to skyrocket as their medicinal research and development continues to mature.

InMed's cannabis-based drugs could be sold in all U.S. states because InMed reports that it will only produce drugs that exclude the psychoactive compound, THC.

Herein lies the real money-maker with InMed's cannabis-as-medicine business model!

Biosynthesis: The Holy Grail of cannabis biotechnology!

Deep in the arcane world of cannabis research, researchers have catalogued a massive resource in trace cannabis compounds holding significant and individually unique therapeutic purpose.

The vast majority of these compounds are so microscopically distributed that extracting any one compound is commercially impossible.

Dr. Hossain knows this...but his research and development of medicinal potential in cannabis compounds has been frustrated by the impossibility of commercializing these compounds' pharmaceutical potential.

The cost of isolating just one of these trace compounds with industry-accepted extraction technology would be staggering. The amount of plant material needed to produce even a few grams of a compound would require growing many hectares of raw marijuana plants.

There's a better way that is both economical and practical...and that's where Dr. Hossain's intellectual property comes into play.

It's called biosynthesis and Dr. Hossain knows how to do this with cannabis compounds.

Simply put, biosynthesis is a means whereby biological processes are harnessed to precisely and organically reproduce any select trace cannabis compound in commercial scale. Literally pounds of the stuff can be produced in a vat...on the cheap...and in a purity that passes all stringent regulatory requirements.

Here's an example of how a biosynthesis process has made its mark in medicine.

It took 56 years for insulin to evolve into a readily accessible drug. A biosynthesis process is what made it possible.

In 1922, Leonard Thompson a 14-year-old boy with type 1 diabetes, became the first patient given medical administration of insulin. The insulin was extracted from animals and isolated for human use. (This is the same approach Dr. Hossain has patented for commercializing the trace medicinal compounds found in a marijuana plant.)

It wasn't until 1978 that insulin became the first human protein to be manufactured through a biosynthesis process. Instead of harvesting and extracting insulin from animals, the biosynthesis process uses a bacterium specifically programmed to produce the pure insulin product exactly as is needed by the diabetes patient. The discovery was made by a company called Genentech. [6]

As a point of interest, in 1980, after perfecting its insulin biosynthesis process, Genentech went public and raised $35 million with an offering that leapt from $35 a share to a high of $88 after less than an hour on the market. The event was one of the largest stock run-ups ever. [7]

By the year 2008, pharmaceutical giant Roche, which had already bought up 55% of Genentech, offered to buy the remaining 45% of the company for $43.7 billion, putting the value of the company at around $79.5 billion! Quite a leap from the $35 million initial raise! [8]

Biosynthesis of cannabis compounds could propel InMed Pharmaceutical to global fame!

With its proprietary cannabis biosynthesis technology, InMed Pharmaceutical can harvest the entire medicinal potential of the cannabis plant!

Nobody on the planet can use this process without InMed's authorization!

In fact, as InMed makes further progress in developing its biosynthesis process, you can expect big pharma to be moving in with great interest...just as Roche did when it moved to buy up Genentech!

What makes all this so important in medicine?

Your body has a unique capacity for assimilating cannabinoids!

Medicines are only effective when your body has receptors to take in the medicinal compound.

The cannabinoids in the marijuana plant are unique in medicine...your body is loaded with cannabinoid receptors...and those receptors are the currently underutilized pathways for delivering an entirely new class of medicines for the treatment of dozens of human diseases.

"Cannabis plants can exhibit wide variation in the quantity and type of cannabinoids they produce. As a result, extracted cannabinoids cannot be commercialized on a large scale. To produce high purity cannabinoids in marketable quantities, InMed's biosynthesis model presents the ideal solution." [9]

–InMed Pharmaceutical website

Biosynthesis is the ideal solution to mass-produce complex organic compounds like insulin mentioned above. It's also the precise technique developed by InMed to commercialize vast catalog of unique cannabinoid compounds targeted at InMed Pharmaceutical.

InMed's processes for biosynthesis of cannabis compounds is built upon proprietary intellectual property!

The biosynthesis breakthrough can ultimately monetize the full potential of medicinal marijuana! InMed Pharmaceuticals product development graph (below) gives you some sense of how enormous the pharmaceutical markets for trace cannabinoid compounds can be.

Virtually all those trace compounds are impossible to extract and produce in commercially viable quantities directly from the plant.

InMed's biosynthesis promises to make every one of the cannabis plant compounds commercially available!

This is absolutely critical to understanding where the opportunity lies with InMed Pharmaceutical

At present, approximately twenty companies focus on the handful of the few extractible compounds in marijuana. Only two are focused on commercial scale extraction (one of which is GW Pharma). Their capacity to produce is limited to plant supplies and extraction technology...they're only picking the low hanging fruit!

Despite its potential, the rest of the cannabis plant has no use to them. That's not because there is no value in the plant... they simply don't know how to harvest its potential!

In a manner of speaking, InMed Pharmaceutical can harvest the entire tree, tip to root!

Remarkably, there's another critical and proprietary component to InMed's biosynthesis technology.

InMed Pharmaceutical harnesses proprietary "bioinformatics" to systematically match a trace cannabis compound to the disease process it can target!

InMed Pharmaceutical compiled a most comprehensive database of therapeutic applications for trace cannabis compounds!

Already, 40 separate disease processes have been identified and catalogued. Within each of those 40 segments, InMed reports an exclusive capability to match a trace cannabis compound to a disease process and potential therapy!

This is staggering in its potential.

Below is the current model for InMed's product development strategy. Every one of these disease processes is targeted for novel new medications based upon trace cannabis compounds that InMed reports it could produce in the purity and quality needed for pharmaceutical applications!

Treatment for just one of these diseases holds market potential ranging minimally from $1 billion to $6 billion or more!

In fact, InMed is already in development stages for two of the 40 diseases, one for glaucoma and a second for a devastating childhood skin disease.

The combined value of these two InMed Pharmaceutical therapeutic paths totals $6.6 billion!

That's over 460-times InMed's current market cap! Talk about undiscovered, undervalued gems!

InMed has the key to unlocking ALL the potential of the marijuana plant and tying each of those compounds to the disease processes in this graph.

InMed Pharmaceutical

Product Development Model

The $120 Billion Opportunity! [10]

40 separate therapeutic tracks...and they are just getting started!

Two therapeutic paths are already in development at InMed Pharmaceuticals...with a total market valuation of $6.7 billion!

The $1 Billion piece...

No INM-750: Epidermolysis bullosa (EB) is a rare genetic disease characterized by extremely fragile skin that blisters or sheds upon the slightest friction, resulting in extensive open wounds that are slow to heal. There are no FDA approved treatments. INM-750 is a topical gel designed to regulate keratin expression in the skin leading to the (re-) establishment of the epidermal-dermal junction – effectively a reversal of the disease. INM-750 is also designed to treat disease hallmarks including expediting wound healing, relieving pain/itching, and reducing inflammation and infection. Pre-clinical studies are underway and Ph1-2a clinical trials are expected to commence in 2018.The $5.6-Billion piece...

INM-085: Glaucoma is an eye disease that manifests as an increase in intraocular pressure which damages ocular nerves and leads to permanent vision loss. Limitations of current therapies include poor compliance and limited efficacy. INM-085 is a combination of cannabinoids in a proprietary topical hydrogel formulation designed as a once daily (nighttime) administration for prolonged transcorneal drug delivery. INM-085 has demonstrated in pre-clinical models substantial transcorneal drug penetration and an increase in blood vessel diameter leading to a reduction in intraocular pressure.Billions more in additional disease targets:

In addition to extending INM-750 into other dermatological conditions and INM-085 into various ocular applications, InMed is exploring the use of cannabinoid-based drug combinations to treat diseases including cancer, neurological disorders and pain.

Everything is setting up to make InMed Pharmaceuticals the fastest growing company in the medical marijuana sector.

Only one thing could be holding it back and that leash is about to come off! New, big money is moving in.

Legendary investor, Bob Cross, has discovered and moved aggressively on InMed Pharmaceutical. It's only a matter of time before this makes market news!

If you want to catch InMed on the ground floor, you have to be in front of this!

Bob Cross has stepped in as a large shareholder in InMed Pharmaceuticals. Mr. Cross has quite the track record and is one of the most successful investors of the 21st century.

- Mr. Cross was co-founder and non-executive chairman of Bankers Petroleum (TSX: BNK). It went from 43 cents to a high of $9.64... a 1,995% GAIN.

- He was co-founder and non-executive chairman of B2Gold (TSX: BTO). It went from 30 cents to a high of $4.30... a 1,333% GAIN.

- He was also a director of Athabasca Potash until it was bought out for $8.35 a share by BHP Billiton.

What he sees with InMed Pharmaceuticals points to monstrous returns for early investors! InMed could be a $50 billion company is just a few years.

...and its share price could go absolutely vertical once word of its technology becomes widespread!

Today, $1,000 buys

10,000 shares of

InMed Pharmaceutical!

The portfolio you load up today with InMed at 10¢ a share could soon be worth a fortune! There is little time to sit on this. You must make your moves now to lock in this entry-level position.

The train is leaving the station! InMed has already applied for two patents on the drugs it currently has in development!

This is where the big bucks can start rolling in. Pharmaceutical giants like AstraZeneca, Glaxo, Merck, etc...these companies are paying fortunes for biotech intellectual property...often buying them out for incredible premiums to shareholders.

Just this September, Forbes reported rumors that big pharma would be bidding on marijuana leader, GW Pharma. Those rumors sent GW shares soaring.

" The special thing about the [GW Pharma] situation is that it could set the entire Cannabis industry ablaze. There are only a few serious acquisition candidates in the industry, and this pursuit will likely drive all of them significantly higher. " [11]

Forbes went on to report that GW was valuing itself up to $190/share. That's a 60% premium to its current share price of around $118!

At "Investor Report Name Here", we believe that the big profit potential in GW Pharma has long since passed. That's particularly the case when you factor in that InMed Pharmaceutical may soon eclipse GW as the leading publicly trading cannabis company in the market.

As a ground floor investment, InMed Pharmaceuticals stands on the threshold of a stunning breakout. The time to look into this is right now.

Seven Reasons to Consider InMed Pharmaceutical as an Aggressive, High-Reward Investment...

- InMed's potential with vastly superior intellectual property could quickly propel it flying past current leader in the medical marijuana pace, GW Pharma.

- Biotechnology companies are consistently among the fastest growing investments in the market. The current boom in legalized marijuana only amplifies that potential, creating an opportunity that could dwarf dot.com days!

- InMed already has two multi-billion drug pathways in development, both of which could be highly attractive acquisitions for big pharma.

- Substantial new investment is already moving into both the sector and InMed Pharmaceutical in particular. InMed is not likely to remain hidden from view much longer.

- With legalization rapidly spreading state-by-state, medical marijuana demand is ballooning. InMed's proprietary technology that utilizes the entire potential of the plant could quickly come to dominate the industry.

- InMed's scientific founders migrated away from GW Pharma when they recognized that GW was not on the right track to capitalize on the full medical potential of cannabis. InMed Pharmaceuticals is now arguably the most advanced biotech in the medical marijuana sector.

- InMed Pharmaceutical not only holds proprietary biosynthesis technology to duplicate trace cannabis compounds...it has proprietary access to the medical database that matches the plant compound to a specific disease process. This one-two punch unlocks the vast untapped pharmaceutical resources in the cannabis plant.

The setup for InMed Pharmaceuticals could not be more favorable to early investors! Industry leader GW Pharma proved the profit potential in medical marijuana. Many of its early shareholders made fortunes as a result, but this is only just beginning!

Remember... the GW Pharma story is just the tip of the cannabis iceberg. InMed Pharmacetical harvests the full potential of the cannabis plant for its shareholders...and that could soon be worth billions!

InMed Pharmaceutical is just getting started! It's time you do the same!

[1] http://www.arcviewmarketresearch.com/media-coverage/ Research shows that based upon currently known uses for marijuana, market projections are that the medicinal side will represent about one-third of the total marijuana market. InMed's potential to commercialize the entire cannabis plant multiplies that potential by orders of magnitude. The company reports its technology and intellectual property can commercialize not just a few extractable compounds, but could biosynthesize in scalable quantities of any one of up to 140 unique cannabis trace compounds.

[2] http://fortune.com/2016/02/01/marijuana-sales-legal/

[3] http://www.inc.com/will-yakowicz/cannabis-raised-104-million-venture-capital.html

[4] https://www.cbinsights.com/blog/cannabis-startup-market-map/ & CB Insights Report 2017, Cannabis: The Rise of an Industry

[5] https://www.leafly.com/news/cannabis-101/cannabinoids-101-what-makes-cannabis-medicine

[6] http://www.diabetes.co.uk/insulin/history-of-insulin.html

[7] https://www.gene.com/media/company-information/chronology

[8] http://www.wikinvest.com/wiki/Roche

[9] http://www.inmedpharma.com/s/cannabinoid-science.asp

[10] InMed's market opportunity in just two out of 40 therapy tracks totals $6.6 billion., which suggests an overall market potential for all 40 tracks in excess of $120 billion. One could argue with the assumptions made to projet that figure, but there's no argument that regardless of what the real number may in fact be, it can be measured in the tens of billions of dollars.

[11] http://www.forbes.com/sites/kenkam/2016/09/15/the-cannabis-based-biotech-sectors-best-buyout-candidates/#39e0c412658c

_________________________________________________________

The Seed Investor Report disclaimer

The Seed Investor (TSI) SAFE HARBOR STATEMENT: Statements contained in this online report and document, including those pertaining to estimates and related plans, potential mergers and acquisitions, estimates, growth, establishing new markets, expansion into new markets and related plans other than statements of historical fact, are forward-looking statements subject to a number of uncertainties that could cause actual results to differ materially from statements made. TSI provides no assurance as to the subject company’s plans or ability to affect any planned and/or proposed actions. TSI has no first-hand knowledge of management and therefore cannot comment on its capabilities, intent, resources, nor experience and makes no attempt to do so. Statistical information, dollar amounts, and market size data was provided by the subject company or its agent and related sources believed by TSI to be reliable, but TSI provides no assurance, and none is given, as to the accuracy and completeness of this information.

DISCLAIMER: The information, opinions and analysis contained herein are based on sources believed to be reliable but no representation, expressed or implied, is made as to its accuracy, completeness or correctness. Past performance is no guarantee of future results. The Seed Investor is an independent subscriber/members-only news website. This online report and document is a solicitation for membership in the The Seed Investor service. The Seed Investor did not receive any Direct compensation with respect to the writing of this online report and document. This stock was chosen to be profiled after The Seed Investor completed due diligence on the stock. The Seed Investor expects to generate new membership revenue, the amount of which is unknown at this time, to its website through the distribution of this online report and document. This constitutes a conflict of interest as to TSI’s ability to remain objective in its communication regarding the subject company. Analysts, principals, associates and employees of TSI do not own or trade equities under coverage. For detailed disclosure as required by Rule 17b of the Securities Act of 1933/1934. TSI is not an investment advisor and this report is not investment advice. This information is neither a solicitation to buy nor an offer to sell securities but is a paid advertisement. Information contained herein contains forward looking statements and is subject to significant risks and uncertainties, which will affect the results. The opinions contained herein reflect our current judgment and are subject to change without notice. We encourage our readers to invest carefully and read the investor information available at the web sites of the U.S. Securities and Exchange Commission (SEC) at http://www.sec.gov and the National Association of Securities Dealers (NASD) at http://www.nasd.com. The NASD has published information on how to invest carefully. Readers can review all public filings by companies at the SEC’s EDGAR page.

Third Party/Agency Disclaimer: Content of this message is published by The Seed Investor and sent to select our mailing list through various marketing media to provide readers with information on selected publicly-traded companies. Theseedinvestor.com newsletter (hereafter called “TSI”) is an information and marketing firm wholly owned by Dynamic Wealth Publishing, LLC and is not a financial analyst, investment adviser or broker/dealer. TSI is in the business of marketing and advertising companies to generate exposure of them by sending alerts to our subscribers for monetary compensation. Dynamic Wealth Publishing, LLC has been compensated five thousand five hundred dollars from IR Media Services Inc. (a non-controlling third party) for advertising and promotional services.